“Crowdfunding is the practice of funding a project or venture by raising many small amounts of money from a large number of people, typically via the Internet. Crowdfunding is a form of crowdsourcing and of alternative finance.” Source: Wikipedia.

There are four main recognised types of crowdfunding, to which this article adds a further two variants we believe deserve specific inclusion.

Crowdfunding isn’t new. Collections at religious services have been with us for centuries. France’s donation of the Statue of Liberty to the USA was without a plinth to stand it on, and a newspaper launched a public appeal to raise the necessary money. Public subscription similarly funded the construction of Nelson’s Column in London’s Trafalgar Square. Paid-for-advertising has carried charity and natural disaster appeal messages to millions of readers, viewers and listeners for decades.

Crowdfunding isn’t new. Collections at religious services have been with us for centuries. France’s donation of the Statue of Liberty to the USA was without a plinth to stand it on, and a newspaper launched a public appeal to raise the necessary money. Public subscription similarly funded the construction of Nelson’s Column in London’s Trafalgar Square. Paid-for-advertising has carried charity and natural disaster appeal messages to millions of readers, viewers and listeners for decades.

What is new is that personal, digital connectivity makes it easier, faster and cheaper for any individuals to publicise their aims directly and ask other people for support. Whether that’s to raise funds for a compassionate cause or a personal challenge or problem, finance a business, generate orders for a product or service, validate an idea for a product or a project, or develop a prototype.

1. What is Donation Crowdfunding?

The contemporary innovation of public collections is that a critical mass of individual members of the public have mobile devices with access to the internet, and in theory are able to ask other people around the world to support their aims.

In reality it usually works much closer to home when people set up a page on a platform such as the global GoFundMe or UK platform JustGiving and distribute the URL to friends, family members, email contacts and people in their personal social media networks. Conversations with local newspapers and bloggers can sometimes get the message carried further afield.

In reality it usually works much closer to home when people set up a page on a platform such as the global GoFundMe or UK platform JustGiving and distribute the URL to friends, family members, email contacts and people in their personal social media networks. Conversations with local newspapers and bloggers can sometimes get the message carried further afield.

Kickstarter also carries compassionate and personal projects run by individuals, though Indiegogo recently announced it is leaving this sector. Many other donations platforms operate within individual countries, and sometimes within specific interest sectors. In the UK these include platforms serving scientific research, archaeological excavations, local community projects and not-for-profit enterprises.

The role of the platforms is to provide a marketplace where people can ask for donations to their project, and donors can be confident in the platform handling the transactions in a timely and professional manner for their money to reach the fundraisers.

What the platforms do not do is promote individual projects, this remains the responsibility of the project owners. Platforms generally charge projects a small percentage of the funds raised.

2. What is Reward Crowdfunding?

The simplest answer is that it’s like donation crowdfunding, except that projects offer rewards, or incentives, to backers. For example, an athlete or sports team may ask for donations to be able to compete in a tournament. If they offer something in return as a memento or acknowledgment of a donation, such as an item of kit, or a signed photo taken at the event, the project becomes rewards crowdfunding.

In addition to highly personal aims, very serious business objectives can also be achieved through reward crowdfunding.

The Indiegogo platform launched in San Francisco in January 2008, the same year Apple launched the iPhone, and it was followed by Kickstarter in New York in April 2009. Both originally focused on raising funds for arts projects.

The successful crowdfunding model was quickly applied to craft and hobby sectors as many people with original and unconventional products were drawn to this innovative way to promote their items to wider and larger audiences than using local craft markets, or trying to do distribution deals with mainstream retailers that satisfy conventional tastes.

Indiegogo and Kickstarter still dominate the reward crowdfunding sector globally, though many countries have their own operators. The largest in the UK, for example, is CrowdfunderUK. And there are also many smaller, specialist sector platforms such as a Japanese one that generates international business, QRATES. This platform enables musicians who are not signed to a record label to take customer orders for vinyl records, and then press them when a target quantity of orders has been reached.

Indiegogo and Kickstarter still dominate the reward crowdfunding sector globally, though many countries have their own operators. The largest in the UK, for example, is CrowdfunderUK. And there are also many smaller, specialist sector platforms such as a Japanese one that generates international business, QRATES. This platform enables musicians who are not signed to a record label to take customer orders for vinyl records, and then press them when a target quantity of orders has been reached.

There have also been, and will continue to be, numerous reward crowdfunding projects that were the start of some big businesses. Gaining vital seed-funding has empowered numerous inventors and entrepreneurs, as well as creatives, on an unprecedented scale. Success on a reward crowdfunding platform provides product validation, or ‘proof of concept’, plus an initial income stream direct from potential end-buyers or backers without a startup business requiring co-operation, or permission, from the traditional gatekeepers of access to markets.

These gatekeepers include banks that control funding, media companies that control what people read, watch and hear about, and stockists who dictate what shoppers can find in store.

Numerous startup businesses first achieved reward crowdfunding success to validate their product and verify consumer demand, and then moved on to equity crowdfunding to acquire the resources to form a company and scale up. A good UK example is The Cheeky Panda, a company making tissue from bamboo. Within 15 months of initial reward crowdfunding to generate £10,000 of orders they went on to run an equity crowdfunding project that valued the company at £5m.

Numerous startup businesses first achieved reward crowdfunding success to validate their product and verify consumer demand, and then moved on to equity crowdfunding to acquire the resources to form a company and scale up. A good UK example is The Cheeky Panda, a company making tissue from bamboo. Within 15 months of initial reward crowdfunding to generate £10,000 of orders they went on to run an equity crowdfunding project that valued the company at £5m.

The roles of the platforms are to provide a recognised and trusted marketplace where projects can be hosted and backers can financially support them with confidence and security. They also provide a lot of help-yourself online advice on how to be successful. They allow projects to post a written pitch, a short video, details of the rewards offered, and provide a means of dialogue with backers and visitors to the project to answer questions and keep people updated on progress.

However, reward platforms do not check that their advice on how to succeed has been followed. Quality control is definitely the responsibility of the project owners. Nor do the platforms put marketing support behind any but a handful of projects (which are usually the best performing ones at any time anyway).

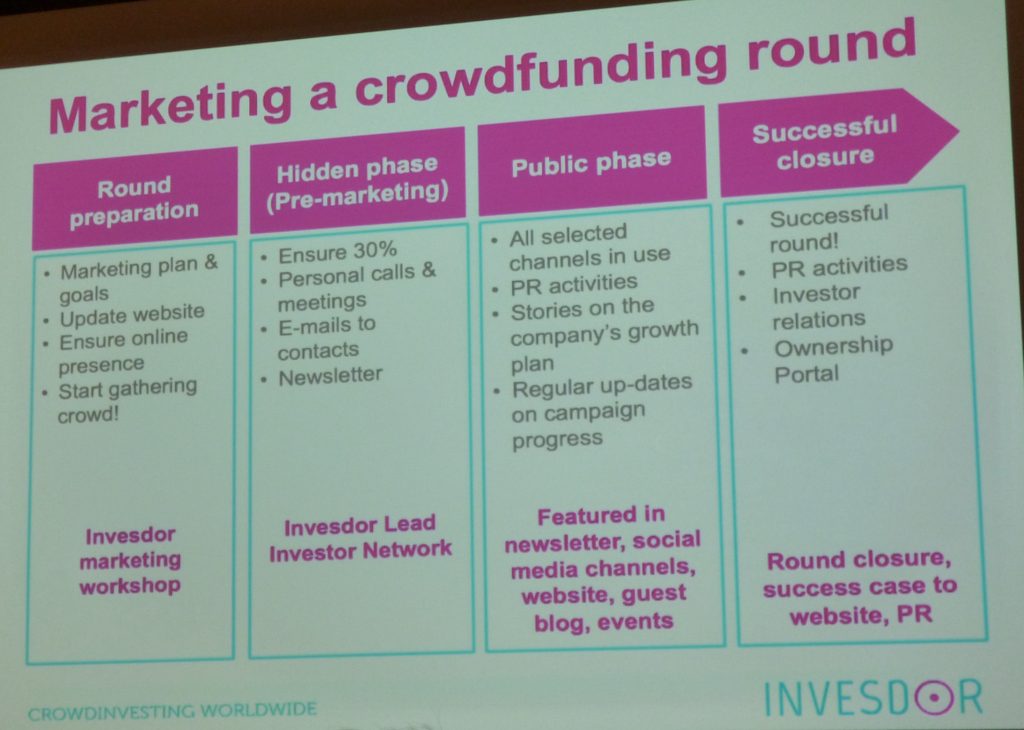

This is why the emphasis in crowdfunding is on the ‘crowd’ element. To hit their targets, successful project owners must communicate their crowdfunding opportunity to an appropriate number of people through social media, email lists, and/or through online and offline media coverage through PR and events. Consequently, there is often a vital pre-crowdfunding stage of crowd-building.

Crowdfunding is not an alternative to personal meetings with potential backers. An empirical rule is that a successful crowdfunding project should reach at least 30% of its financial target within the first few days. This creates vital momentum and can pull in other backers who would otherwise be more likely to remain on the sidelines. Project leaders and their teams should carry out personal pre-selling to secure sufficient pledges of support before going live.

Two ways that reward crowdfunding platforms operate.

The choice of which platform and which type of reward crowdfunding to use is very important.

On an “all or nothing basis” a project has to receive pledges that meet or exceed its financial target to receive any money. If by the project closing date the money raised is below the target then the backers don’t have to pay anything, and neither the crowdfunding project or the platform receive anything, as the platforms charge a percentage fee based on the money raised by successful projects.

This protects backers from making contributions that may be frittered away if the total raised is not enough for a project to achieve its aims, such as create a prototype, attend a sports tournament, shoot a film, or whatever.

“All or nothing” also protects a project owner who wants to generate product orders against having to go ahead with a low, uneconomic level of orders that would mean incurring a loss. Kickstarter works on the “all or nothing” basis.

The second method is “keep it all” – even when backers pledge a funding total that is below the target. This method is most useful to people or organisations that have an existing stock of goods and are using reward crowdfunding as a distribution channel. Indiegogo works mainly on this basis. The biggest implication of hitting target or not is Indiegogo charges successful projects 5% and unsuccessful ones 9% of the sum raised.

Despite some reward projects generating incomes running to seven or even eight figures (such as Pebble smartwatches, Oculus Rift virtual reality sets, Skully motorcycle helmets), US financial regulators were for years reluctant to allow crowdfunding to be anything more than a means for people to ask the public for donations of early seed investment, or a quasi-sales channel to take pre-paid orders. The development of equity crowdfunding was led by UK platforms.

3. What is Equity Crowdfunding?

Equity crowdfunding is a means for private companies (i.e.not listed on a stock exchange) to secure investment from backers in exchange for a share of company ownership.

After the 2008 economic recession when banks tightened their lending and interest rates were low, there was an opportunity to connect high net worth individuals who had money they wanted to put to work with startup businesses that needed funding.

The Crowdcube platform was launched in 2011 and Seedrs followed in May 2012. Between them, these two platforms now handle over 80% of the UK equity crowdfunding volume. An article covering US equity crowdfunding is here.

Other countries are at various stages of developing or even allowing equity crowdfunding at all. Here’s a selection.

A report on the alternative finance sector in Europe shows the UK remains the front runner, though the gap between it and other countries is narrowing.

A report on the alternative finance sector in Europe shows the UK remains the front runner, though the gap between it and other countries is narrowing.- The various pieces of JOBS Act legislation in America restrict how much the majority of its citizens are allowed to invest in private companies, and restricts private companies on how much they can raise.

- Currently, Australia allows equity crowdfunding only for companies already publicly owned and excludes private ones, though it is likely this will be remedied by August 2018.

- In India the financial watchdog SEBI ordered the first few equity crowdfunding platforms to close in September 2016. It believes the public has insufficient understanding of how equity markets operate and needs to be protected from risks inherent in equity crowdfunding until thorough legislation is in place.

The roles of the platforms are more complex than for donation and reward crowdfunding given the legal implications of company ownership schemes. Platforms’ roles include, though are not restricted to:

- Ensure projects meet tax rules, legal liabilities, and accounting requirements.

- Post written and video pitches on their site and facilitate full safe and secure online transactions.

- Check project owners are not disqualified for any reason from raising equity funding.

- Maintain the confidence of their networks of investors by ensuring project business plans and financial forecasts stand up to scrutiny.

- Transfer funds to project owners upon successful completion of the crowdfunding.

- Handle all legal requirements of shareholder registration and issue share certificates.

Marketing. Each platform has a network of registered investors who they inform about the crowdfunding projects that they host and organises live events for project owners to meet potential investors. Getting further marketing support from the platforms is possible, though subject to negotiation or a cost.

Project owners should run their own marketing to drive a crowd of potential backers to their project, largely through personal contacts, social media and PR.

As with reward crowdfunding, the equity crowdfunding platforms charge a % fee based on the sums raised by successful campaigns.

Advantages of equity crowdfunding for investors include tax incentives (which vary by country, so check on this where you live or conduct your business) and a potentially very high return on investment (ROI) when a business is successful.

Disadvantages for investors include:

- startups are generally prone to high failure rates. A prudent investor will therefore back a range of crowdfunding projects, hoping for an ROI on the successes that will compensate for the more numerous failures.

- investors’ money can be tied in for several years until the business is either sold or becomes publicly traded on a stock exchange.

4. What is Debt Crowdfunding?

Also known as peer-to-peer (P2P) lending, it is a means for investors to lend their money to entrepreneurs for fixed periods of time and at fixed interest rates that provide them with a better ROI than regular retail banking opportunities.

Borrowers must usually be an existing business that has progressed beyond a “proof of concept” stage, and provide either a two year trading history or put up security against the value of the loan.

Major platforms include:

- Lending Club in the USA which offers small businesses up to $300,000 (c. £215,000)

- Zopa which has so far lent £3bn to UK customers

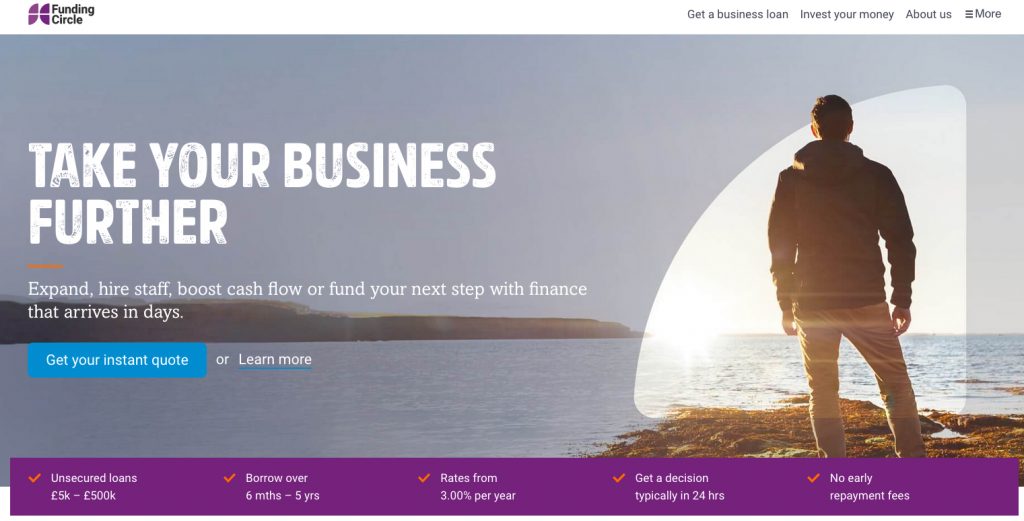

- Funding Circle launched in 2010 and operates in the UK, USA, Germany, Spain, and the Netherlands. As of May 2017, Funding Circle has dispersed over £2.2bn (c. $3.1bn) in loans to small and medium-sized firms.

Many other countries have their own debt crowdfunding platforms. In India, RangDe.org provides micro-loans to small business borrowers, over 90% of whom have been women.

Sometimes loans are structured as an investment in bonds.

The main advantages of debt crowdfunding for lenders are the security of fixed repayment dates and relatively generous levels of returns. For borrowers, it provides lower interest rates than available from retail financial service providers, faster approval, and they retain their equity levels in their business.

The main roles of the platforms are to create the marketplace to connect the lenders and borrowers, undertake due diligence to verify the authenticity of the borrowers’ claims, and facilitate the financial transactions. They are regulated by national financial authorities (eg UK’s FCA, USA’s SEC, India’s Sebi).

Several platforms provide both an equity crowdfunding and a bond-based p2p loan service, such as the UK’s Crowd For Angels.

5. What is Real Estate Crowdfunding?

Real estate developers can open up investment opportunities to networks of small scale investors in order to raise capital. People are able to invest collectively in property deals that would be beyond their means on an individual basis, and they share the developers’ risks and rewards.

Real estate/property crowdfunding can operate on debt or an equity basis, with properties either held longer-term to generate a rental income or sold upon completion or refurbishment – ideally for an immediate profit, money is at risk.

Leading US real estate crowdfunding platforms include RealtyShares (requires a minimum investment of $5,000 in pre-screened residential, commercial, retail, and mix-use properties), RealtyMogul (commercial real estate, minimum $5,000 investment), and Patch of Land (mainly but not exclusively residential real estate

UK platforms include the market leader HouseCrowd, which claims to be the first property crowdfunding platform in the world (£1,000 minimum investment), and PropertyPartner, which since its launch in 2015 has helped over 10,000 investors collectively purchase nearly 700 properties.

UK platforms include the market leader HouseCrowd, which claims to be the first property crowdfunding platform in the world (£1,000 minimum investment), and PropertyPartner, which since its launch in 2015 has helped over 10,000 investors collectively purchase nearly 700 properties.

In both the USA and UK, and in other countries, there are plenty more platforms.

Property crowdfunding can be a more flexible way to invest than equity crowdfunding as estimates of any given property’s value are readily available. This allows a secondary market for investors to sell their personal stake in a scheme ahead of overall project completion.

6. What are Initial Coin Offerings (ICOs)?

ICO’s are a form of crowdfunding through the sale of coins, or tokens, that can be redeemed at a later date against the cost of acquiring goods or using services provided by the company issuing the coins. ICO’s do not transfer ownership of company equity.

Beyond the appeal of any coin issuing company’s actual products or services, there is also the possibility of the coins appreciating in value if the company is successful, which has captured many people’s imaginations. Though they could also depreciate and fall in value.

In Sweden, electric vehicle manufacturer Uniti has announced plans to work with a Swedish bank and launch the world’s first Green ICO. At a corporate level, other businesses will be able to trade their coins for performance data on the first Uniti vehicles on the road. At an individual level, personal coin purchasers will be able to use them against the cost of charging batteries.

In Sweden, electric vehicle manufacturer Uniti has announced plans to work with a Swedish bank and launch the world’s first Green ICO. At a corporate level, other businesses will be able to trade their coins for performance data on the first Uniti vehicles on the road. At an individual level, personal coin purchasers will be able to use them against the cost of charging batteries.

Also, there are crowdfunding platforms launching their own ICOs to pre-sell tokens to investors that they will use to invest in the crowdfunding projects the platforms carry. One such platform is the UK’s Crowd For Angels.

However, both sensational increases in the value of Bitcoin in 2017, and its price volatility have fuelled speculative interest in ICO’s as an investment asset rather than an alternative currency. The sector has attracted the interest of financial regulatory bodies in many countries, including the USA’s SEC and UK’s FCA, who may consider bringing ICO’s into their areas of control.

ICO’s are a complex and fast-changing development in the crowdfunding marketplace that will require constant attention to stay on top of.

0 Comments