Crowdfunding is by no means easy: most projects fail. Effective communication of crowdfunding opportunities presents unique information challenges for entrepreneurs who must convince funders to support their project, while at any time the latter are interpreting the information provided by many rival pitches to decide which ones to back. The information signalled on the crowdfunding page is vital to capture the attention and motivate funders. Want to know which words work better than others?

Potential backers examine extrinsic elements to try and form a view on the intrinsic merits of each equity or new product investment: funders are more likely to support projects which indicate higher venture quality through the observable signs disclosed in the campaign. Relevant factors include the use of multimedia, previous experience of the entrepreneurs, their social networks, the commitment of angel investors, and the regular use of updates. However, few studies have looked at aspects related to the narrative of the campaigns – the actual words used in a pitch.

After studying hundreds of thousands of crowdfunding campaigns we identified specific words or combinations of words that are more successful in achieving fundraising targets.

Entrepreneurship as a science that can be learnt

Startup entrepreneurs naturally want to follow in the footsteps of successful business leaders, and consume a multitude of biographies and articles written by them. Yet these written works each tend to deal with one way of doing things at a particular moment in time, and often in just one market sector.

In 2001, Dr Sarasvathy carried out a study to discover what successful entrepreneurs have in common (if anything), and break down their behaviours and thought processes in to elements that could be taught. This would enable people to study how to be a successful entrepreneur. Her work was based on the responses of 27 expert entrepreneurs when faced with a series of challenges they might come up against in launching a new business.

MBA students have long been taught the ying and yang of effectual reasoning and its counterpart, causal reasoning. Both are integral parts of human reasoning that can occur simultaneously, overlapping and intertwining. Yet they steer decision-making in different ways. Causal reasoning aims to achieve desired goals through following a specified set of pre-determined measures. Causation invokes ‘search and select’ tactics and is the foundation of most good management theories. Whereas effectual reasoning is based on using a set of evolving means to achieve an equally evolving set of new and different goals. One is rigid, one is fluid.

Sarasvathy’s studies concluded that causal thinking is definitely required to launch a business – a detailed assessment of the marketplace, competitors, likely impact of internal and external factors, and so on. It addresses “the known.” Sarasvathy also found that the expert entrepreneurs did share a common logic in solving entrepreneurial problems. That common logic was the degree of flexibility they showed to manage, even harness, unplanned or unforeseen eventualities: an ability to deal with “the unknown.”

Methodology

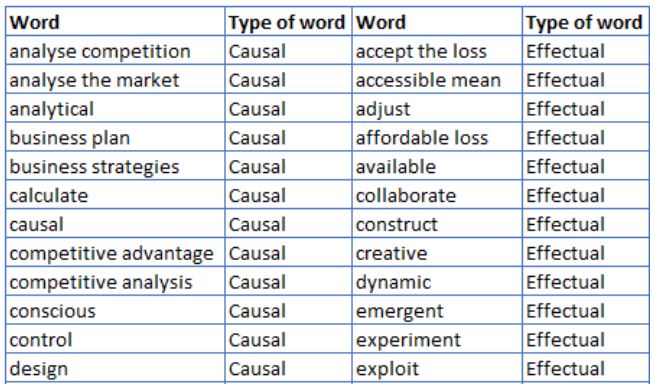

Previous work has identified words and phrases that correlate more with either causal or effectual reasoning. Here is a selection of what we looked for in crowdfunding narratives – the written pitches.

In total there were 193 words or phrases related to a causal orientation, and 186 related to an effectual orientation. Of these, 51 and 56 respectively were core words or phrases.

Our assessment of successful crowdfunding projects went beyond the simple, single measure of reaching their financial target or not. There can be massive degrees of success through overfunding, or failure with a project that didn’t get anywhere near its target as opposed to just falling short. Consequently, we devised a weighting to apply to the presence of specified narrative phrases depending on the relative performance of projects against their targets.

Results

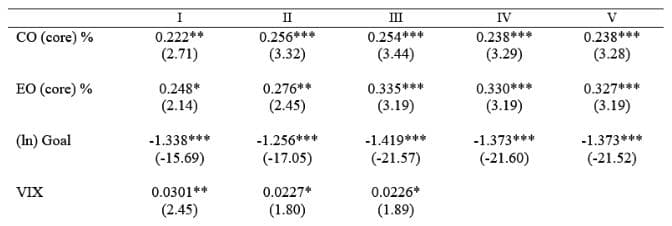

Our econometric modelling showed that increasing the effectual wording by up to 5% can increase the probability of crowdfunding success from 43% to 60%.

Increasing the effectual core words or phrases by up to 5% can increase the probability of success from 45% to 65%.

A practical example

Here is a phrase in the narrative of a campaign which includes causal words (underlined).

“To reach our goals we have conducted extensive market and competitive analysis paving an in-depth plan to what will be implemented to maximize our customer base in the long term.”

The following is an example of how the phrase could be tweaked to include more effectual words (underlined), thus potentially benefiting the outcome of the campaign.

“To reach our goals we will collaborate and engage creatively with our existing customers and experiment with different approaches to see which one works best, and growing our customer base as we go.”

Why does effectual narrative work better?

Higher levels of effectual language perhaps suggest the degree of comfort, or lack of, with which a startup team will cope with the unknown.

Angel investors invariably require an entrepreneur to have written a business plan, and are then sometimes quite happy to discard the financial projections as meaningless beyond the fact that assembling them has certainly made each fundraiser focus on them. And of course business plans aren’t meant to be filed away, they are important working documents to be continually amended depending on changes in circumstances and results.

Implications for investors and fundraisers

It is possible that frequent crowdfunding backers become attuned to the correlation of effectual wording and the success rate of businesses, and perhaps begin to recognise it almost subliminally. If you’ve not yet reached this level of sophistication with your investment decisions, now you know more about what to look for.

If you are a potential fundraiser, I hope that with this information you may better understand how important it is to plan every detail of your campaign to achieve success. Regardless of how good the product and/or service is and how attractive it might be to the market, if you use the wrong words in your pitch you may fail. I wish you good luck with your crowdfunding campaigns, even though I have shown you how to lessen the impact of chance!

Main image source: Gaelle Marcel on Unsplash

How useful do you find this article? Has it influenced any plans you may have to either run or back a crowdfunding project? Please share your thoughts on this with us.

0 Comments