The power of crowds, who can link together and organize effectively through smart mobile technology, is disrupting traditional power bases at political, corporate, media and financial levels. The rise of populist political leaders who communicate with their constituents directly through social media, Airbnb’s Open Homes program encouraging spare rooms or guest houses to be made available to displaced people or relief workers in disaster areas, and the rise of the cross-border gig economy where freelancers provide their skills when and to whom they choose, all represent the empowerment of individuals as part of organized crowds and the growing decentralization of traditional control levers.

For many entrepreneurs (and d-i-y investors who back them) the most significant form of crowdsourcing has been crowdfunding. Rather than trying to impress a single backer to support a business idea, perhaps through chasing a government or bank loan or by catching the attention of an angel investor, crowdfunding has decentralized the process and enables business startups to ask crowds of people to each provide a relatively small level of support. Although some of the businesses supported by crowds of sometimes unsophisticated backers might be mocked by professional investors for some fanciful financial forecasts, many disruptive and challenger brands have emerged whose impact on established business sectors often far outweighs their market share or company valuations.

Favourable “light touch” treatment by UK financial regulators of equity crowdfunding (where investors pay for a slice of ownership of a business, and accept the risk that it may fail) allowed the country to emerge as the world’s market leader. Crowdcube was one of the first equity platforms to appear, in 2011, and it recently announced a total figure of more than £500 million invested so far in 700 funding rounds. The banking app Revolut and the Scottish brewery Brewdog, both currently worth over £1 billion, launched through Crowdcube.

Here’s a snapshot of four business sectors disrupted by challenger brands using the power of crowds.

Banking

London-based Revolut, the UK’s fastest growing fintech company, ran a crowdfunding campaign as recently as 2016 to raise £1m and get started. Crowdfunding was also good marketing for them as it generated a core crowd of hundreds of investors who would become keen customers and brand influencers.

Revolut’s CEO and co-founder Nikolay Storonsky: from a fintech startup to a $1.7bn business in three years

The co-founders’ business idea came from their personal frustration with exchange rate markups, inexplicable foreign transaction fees and the overall hassle of managing a bank account abroad.

Today, Revolut provides over two million customers (two million customers acquired in two years!) with a debit card allowing the holders to spend money in 150 currencies with no fees. They estimate they have saved their customers over £560m in traditional banking fees, and in 2018 raised $250m through corporate investment which valued the business at $1.7bn (£1.2bn).

Brands like Revolut and fellow banking newcomer Monzo are definitely shaking up the traditional banks and changing customer expectations.

Brewing

Behind Brewdog which is now a unicorn startup valued at over £1bn, there are many smaller craft brewers that continue to launch with modest funding and provide UK drinkers with a vast choice of beers and ales made with finer ingredients than high volume mass-market brands can access in sufficient volume.

An example is the fast growing Hop Stuff Brewery in London. City finance professional James Yeomans found he enjoyed home-brewing more than his time spent in the office and became determined to take it further. Regardless of no commercial brewing experience, in 2013 he used equity crowdfunding to raise £58,000 in exchange for 34% ownership of his startup craft beer brewery.

An example is the fast growing Hop Stuff Brewery in London. City finance professional James Yeomans found he enjoyed home-brewing more than his time spent in the office and became determined to take it further. Regardless of no commercial brewing experience, in 2013 he used equity crowdfunding to raise £58,000 in exchange for 34% ownership of his startup craft beer brewery.

The business grew, and alongside attracting corporate investments it ran a second round of equity crowdfunding that closed in January 2017, and then a third smaller one in early 2018. Although corporate investors were by now queuing up for a slice of the business and crowdfunding was unnecessary on purely financial terms, crowdfunding has provided Hop Stuff with a dedicated following of over a thousand supporters happy to perform unofficial Brand Ambassador roles. They influence people to sample the brewery’s products through positive word-of-mouth, and ask pubs and bars where they drink to stock them.

Hop Stuff is currently opening a number of its own “beer and pizza” bars, and is filling a global overseas order book and signing franchise brewing agreements. Compared with the rest of the UK beer trade, the British Beer and Pub Association (BBPA) recently reported annual sales were 1.7% down, and in August 2018 the BBC reported UK pubs are closing at a rate of 18 a week. Hop Stuff Brewery is certainly bucking the trend, has just moved to larger brewing premises, and five years after launching with £58,000 raised through crowdfunding it is valued at over £25 million.

Recognising the value and power of a dedicated crowd, Full Circle Brewing Company in Fresno, California, ran a hybrid crowdfunding project this year. Alongside $685,000 traditional corporate debt financing they aimed to raise $124,000 through personal equity crowdfunding. The minimum investment for an individual investor was $500, though many backers put in more, and they had raised $165,500 when the project closed in March 2018.

Recognising the value and power of a dedicated crowd, Full Circle Brewing Company in Fresno, California, ran a hybrid crowdfunding project this year. Alongside $685,000 traditional corporate debt financing they aimed to raise $124,000 through personal equity crowdfunding. The minimum investment for an individual investor was $500, though many backers put in more, and they had raised $165,500 when the project closed in March 2018.

Insurance

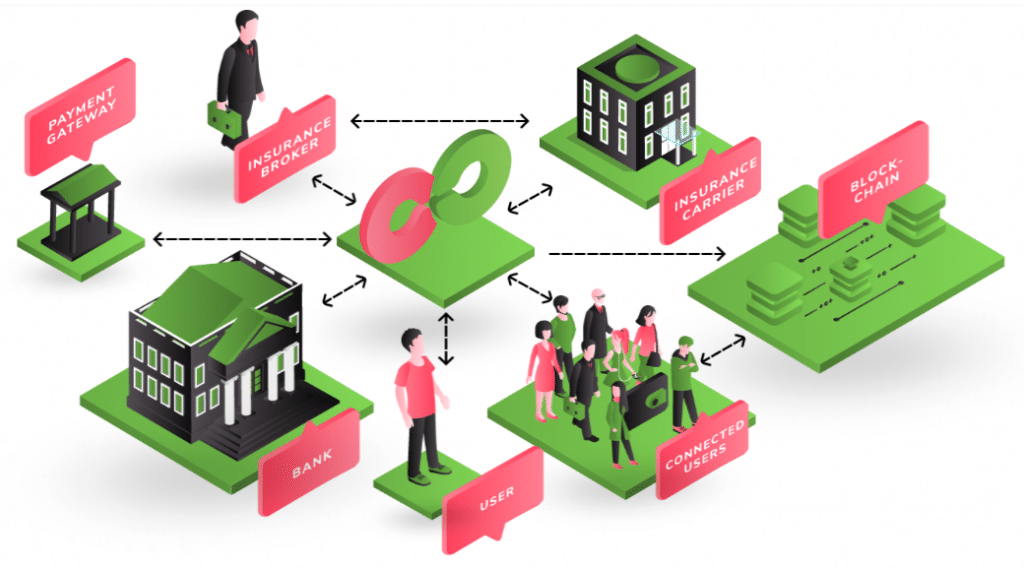

Newcomer VouchForMe (formerly InsurePal until July 2018) offers next generation peer-to-peer insurance based on crowdsourced social proof endorsements, plus blockchain technology.

Using motor insurance as an example, VouchForMe uses crowdsourcing to sign up good drivers based on personal reputations among their peer groups. An “introducer” can endorse a friend, colleague or family member as a good driver, and if accepted the driver will pay lower motor insurance premiums. The introducer is rewarded with IPL tokens based on the Ethereum blockchain, and they can be used as payment towards their own insurance premiums or converted to a cash currency.

The size of a driver’s premium discount is the decision of the endorser, who has to provide credit card details, and the card will be charged the amount of the policy saving if a driver they endorse files a claim in the first 12 months and the incident was their fault. So people aren’t going to put forward anyone they know who’s not a good driver, which minimises the risks for VouchForMe.

After 12 months the introducer’s personal liability is over and the driver they personally vouched for continues to enjoy their lower premium.

Grocery items

Bamboo is a fast-growing sustainable product with four growth cycles a year. Tissues made from bamboo rather than paper are naturally stronger, softer and more hygienic. They can be made with a 65% smaller carbon footprint.

Who created and introduced this breakthrough eco-friendly product to the UK? It wasn’t corporate giants Kimberly-Clark or Procter & Gamble that own some market-leading worldwide tissue brands. It was a pair of UK holidaymakers who returned home from China and wrote a business plan to utilise abundant supplies of unwanted surplus bamboo they had seen being left to rot.

Who created and introduced this breakthrough eco-friendly product to the UK? It wasn’t corporate giants Kimberly-Clark or Procter & Gamble that own some market-leading worldwide tissue brands. It was a pair of UK holidaymakers who returned home from China and wrote a business plan to utilise abundant supplies of unwanted surplus bamboo they had seen being left to rot.

A modest reward crowdfunding project with a target to generate £10,000 of orders gained the attention of a crowd of early adopters and an angel investor. Within three years the founders of The Cheeky Panda tissue company ran an equity crowdfunding campaign that raised £500,000 and valued their business at £5m. The brand is a top seller on Amazon.

So even in the high-volume fmcg sector (fast moving consumer goods) dominated by massive brands that are supported with multi-million advertising budgets, crowdfunding – the crowdsourcing of both money and a community of supporters – enables entrepreneurs to introduce innovative products and disrupt existing markets.

Fast changing trends and developments in crowdsourcing can be hard to keep up with. A great way to stay on top is to attend our #CSWGlobal18 conference running 24-28 October in Washington, D.C. Thought-leaders and top crowdsourcing practitioners from around the world will take the stage for two days at the iconic Carnegie Institution for Science, followed by an optional two days of tailored expeditions to the nearby National Air & Space Museum and the Smithsonian Institute – iconic facilities that have both embraced crowdsourcing. Here is an Agenda and tickets are available with a limited number of time-sensitive offers, including Team Passes. We hope to see you there.

0 Comments