Crowdsourcing Week’s Theme of 2022

I believe 2022 will be a pivotal year for how we live and work, and for many aspects of the crowd economy. Decentralization and deglobalization deliver a more even distribution of power in society, and it’s our theme in 2022. There are powerful tools at our disposal to help us achieve that goal, though the process begins with a mindset that we want to do so. At the same time, there are power bases that want to protect their current status and maintain their vested interests.

In September 2021, after being among the earliest countries to enthusiastically embrace cryptocurrencies, China’s central bank declared that all cryptocurrency transactions were illegal. This effectively banned digital tokens such as Bitcoin. To maintain the Chinese government’s vision of a state-dominated economy, it is currently piloting its Digital Chinese Yuan. This is a state-backed digital currency designed to offer the surface-level convenience of cryptocurrency, though without its privacy and decentralization benefits, and able to now operate in a competition-free environment.

Nine governments have so far issued a digital currency. I predict China will roll out its digi-currency, and where China leads, other major governments will follow with their own central bank digital currencies. Governments want to track the flows of digital currencies just like they track our incomes and tax us. What will happen to the $3 trillion market capitalization of the decentralized crypto space?

Decentralization through crowd sharing

Decentralization has been marked by a move away from reliance on markets for goods or services controlled by “gatekeepers” who control and authorize activities, usually for the given reason of “protecting” us. However, mass digital connectivity allows self-regulating P2P and C2C (peer-to-peer and consumer-to-consumer) activities through online platforms and apps. The global financial crash of 2007/8, brought about by the authorized and regulated “banking establishment” of the financial sector, was a catalyst that spurred wide development of crowd economy business models.

Tighter post-crash controls on bank lending restricted funding available to startup businesses. In what became a generational shift, entrepreneurs who had grown up as digital natives spotted opportunities and moved fast to exploit them in ways that disrupted accepted business norms. The sharing economy model became providing goods and services from surplus and under-used capacity that already existed in a marketplace. That is, from assets already owned by other people, rather than acquired and then provided by centralized businesses.

Airbnb launched in 2008. By New Year’s Eve in 2009, 1,400 guests were staying in accommodation provided by hosts who wanted to monetize a spare room or a sofa bed. By 2018 it was three million. Uber launched in March 2009, allowing people to book car rides with private car owners who wanted to monetize their vehicles, which on average sat idle for 95% of the time. Both platforms harnessed the mass personal connectivity delivered by handheld technology: the 3G iPhone launched in over 80 countries and territories in 2008.

The crowd sharing business model allows startups to scale fast because they do not need funding to acquire assets – they recruit providers who want to monetize assets they already own. The model has been applied to personal clothing, power and d-i-y tools, driveways to offer parking spaces, the use of yachts and executive jets – and even money itself through the development of decentralized finance.

Decentralized finance

Crowdfunding platforms provide an online marketplace for private enterprises that seek funding from backers looking for new products, or for investment opportunities with a prospect of better returns than retail banks and consumer financial service providers. Crowdcube, the first equity crowdfunding platform, launched in the UK in 2009.

Peer-to-peer lender Zopa had launched earlier in 2005, though the post-crash period and growing smartphone ownership saw it take off, accompanied by the launch of many other “me-too” operators.

Bitcoin, the first crowd-backed cryptocurrency, launched in 2009. The “financial establishment” had almost collapsed the world economy, and a currency beyond their control that would enable cross-border payments, recorded on decentralized blockchain technology, had an almost rebellious attraction.

Bitcoin, the first crowd-backed cryptocurrency, launched in 2009. The “financial establishment” had almost collapsed the world economy, and a currency beyond their control that would enable cross-border payments, recorded on decentralized blockchain technology, had an almost rebellious attraction.

Bitcoin’s growth, and that of the cryptos that followed it, was spurred by wide social media comment – decentralized C2C mass messaging beyond the control of established media owners who operate as gatekeepers on the content they share.

NFTs (non fungible tokens) have created a new asset class through enabling secure ownership of online assets, acquired with cryptocurrency and recorded on blockchain.

Crowd economy hiccups

Some recent developments have shown that decentralization is not a continuous, linear development.

Profits in the equity crowdfunding business model were reduced by the costs of servicing an ever growing number of historic transactions, among other factors. The two leading, though loss-making UK equity crowdfunding platforms, Crowdcube and Seedrs, were denied permission to merge in 2021. There is a wider prospect of platform consolidation within the sector after Seedrs was acquired by its U.S. counterpart Republic.

Tough trading during the COVID-19 proved too much for some small businesses who defaulted on their P2P loan repayments. A subsequent loss of investor/lender confidence in the sector caused the closure of a number of platforms.

Uber, and other similar ride providers, continue to face court cases over whether their drivers are workers or self-employed. This has massive implications for possible corporate tax liabilities, and long-term fare pricing that could undermine the basic premise of being cheaper than traditional taxi services.

Airbnb is blamed for too many properties being removed from the housing market as owners choose to provide short-term vacation accommodation rather than operate as longer-term landlords, exacerbating levels of homelessness.

Gig workers can sometimes pay a human price when mis-managed by automated algorithms. Work opportunities can be ended at short notice due to issues that can include false customer feedback and failures of racially biased facial recognition technology. Workers find it difficult to refute software errors that their managers also fail to understand. There is also a general lack of transparency about how worker data is used. For example, could false customer feedback ultimately impact on a gig worker’s future employment prospects?

Longer-term trends remain in place

Work. Unprecedented numbers of people are resigning from their jobs. Many are giving themselves the flexible option to end working for a single employer to take on several roles. Anyone can decide their own combination of a number of options: working in the creator economy; micro-tasking; white collar freelance skills such as cybersecurity, translating, graphic design and other marketing services; “last mile” delivery of online purchases; providing accommodation; providing a transport service.

Decentralization in the workplace includes corporate acceptance of remote working from home, and that employees can be trusted to maintain their productivity. Many mainly white collar workers are going to stay working from home at least some of the time each week. There are knock-on effects for public transport systems that are dealing with underfunding from lower ticket revenue, city centre small business service providers who have fewer customers, and a boom time for videoconferencing platforms.

Education. Decentralization in education is not yet as advanced as in other sectors, but it is moving more online which could lead to options for a college level (tertiary) education with no need to attend a central campus. Will degrees become more modular, with students enrolling at various establishments to complete a composite series of mini-courses, with results stored in an immutable and trustworthy blockchain based system?

At a corporate level, decentralization includes the vital search for and development of breakthroughs and innovations by going beyond a specialist in-house R&D team, and using prize challenges and other open innovation techniques.

In government, decentralization involves a transfer of centralized control, decision-making and spending to regional – even local – authorities. It encourages and allows greater involvement by the electorate. There are numerous examples of using civic crowdfunding to highlight options local residents want their local authorities to approve, fund, or in some other way support.

Self-controlled decentralized systems

In all of these sectors, platforms vet participants to ensure they meet criteria to take part and deliver what they are supposed to. Many have approval systems for participants to rate each other and highlight weak links that perhaps ought to be excluded.

Trading and transacting in this style will continue to grow due to several factors:

- a move for greater self-determination than reliance on a single employer;

- to maximize self-development in areas of special interest;

- greater trust in the platforms;

- more widespread understanding of the procedures.

What are the prospects for Deglobalization?

Does the future belong to globalists or patriots? Globalization is based on the economic principles of bringing together factors of production in locations that enable the most economically advantageous use of resources. A concentration of resources also delivers economies of scale. The ebb and flow of globalization is not a new phenomenon, and deglobalization is itself a form of decentralization at a macro-level.

When particular industries or business sectors start to congregate, they create a marketplace that attracts an ecosystem of relevant suppliers and skilled workers. However, the market dominance that key players can achieve becomes a barrier to market entry elsewhere. An over-reliance on an established market can also lead to problems over flexibility and a lack of diversity. At the height of the post-1929 Depression, British economist Keynes encouraged deglobalization, stating: “We do not wish…to be at the mercy of world forces working out, or trying to work out, some uniform equilibrium, according to the principles of laissez faire capitalism.”

In addition to economic factors, there are also geo-political and technological factors.

Photo by Diego Fernandez on Unsplash

Prolonged peace time without major conflicts between superpowers since 1945 allowed low-friction trading and the creation of long, though reliable, supply chains between continents. The western economies rely on goods made in Asia, even if the brand owners are “domestic.” Infrastructure was created. Asia came to dominate world shipbuilding to build the fleets required to carry the containers of manufactured goods to the end-user markets. Steel and energy were needed to make the ships and the containers, and so on.

The impact of technology also strengthens established marketplaces as its early use is often relatively expensive, and requires deep pockets to invest in and develop it. Four key technologies that have underpinned the latest phase of economic globalization are:

- IoT (Internet of Things) connectivity between devices optimizes supply chain and operational efficiencies, plus security.

- Artificial Intelligence enables better predictive risk assessment to forecast demand, and then optimize output and stock levels.

- Cloud logistics enable real-time solutions for transport scheduling and inventory control, and tracking to know where goods in transit are on their journey.

- Blockchain provides immutable records of deals and timings, implements smart contracts and minimizes fraud.

Global supply chains have experienced Covid-related disruptions and knock-ons. Lockdowns and infections created labor shortages, reducing factory outputs. Ships were held up at ports as they became bottle necks. Goods were often stockpiled at ports due to a truck driver shortage. Panic buying in the face of erratic supplies cleared retail shelves and emptied the storage tanks at petrol stations. Car factories had to close due to a lack of microchips and semiconductors. Energy shortages are going to ramp up prices which will fuel inflation rates. Are these issues just temporary, and we can expect everything to return to previous normality? Or are they signs of underlying faults that require deglobalization to resolve them?

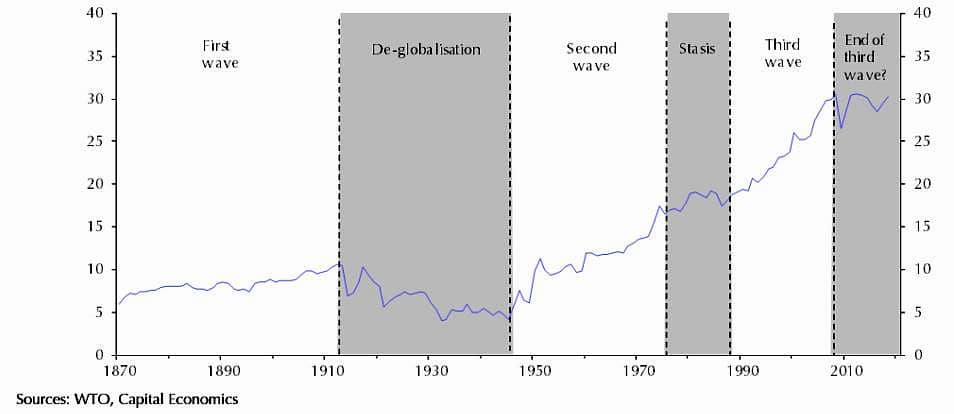

World Trade Organization exports data suggests the most recent phase of globalization may have already passed its peak anyway, and we have been in a period of deglobalization for over 10 years. The value of world exports, measured as a percentage of Gross Domestic Product, has hardly increased since the financial crash of 2008.

World Exports of Goods and Services (as a % of GDP)

Source: www.capitaleconomics.com

Let’s go back and look again at the economic, geo-political and technological drivers of globalization, and see what has been changing to favour deglobalization.

Economic factors

Workers in the developing economies making so much of the world’s goods want to enjoy an improved standard of living as their reward for contributing to the rise in national prosperity. However, higher wages reduce their competitive advantage and the reasons for the factories to be there.

Shipping costs have risen to around eight times higher than before Covid.

Western consumers are also more aware of carbon emissions, and increasingly question the cost of climate damage by shipping mass produced goods vast distances around the world.

Geo-political factors

Democracies are having to deal more with autocracies. Short of armed conflict, there are now many more ways that nations can try to interfere with and destabilize others. Fake and biased news can stir social unrest, influence voters and impact on election results. President Putin is using western Europe’s reliance on gas supplies from Russia, along with troop build-ups along the shared border, to extract concessions over demands regarding Ukraine. The U.S. is suggesting it could respond to armed aggression by blocking Russia’s financial institutions from the SWIFT payment system. There have already been examples of cyber hacks paralyzing energy supplies, medical services and digital smart city infrastructure.

Democracies are having to deal more with autocracies. Short of armed conflict, there are now many more ways that nations can try to interfere with and destabilize others. Fake and biased news can stir social unrest, influence voters and impact on election results. President Putin is using western Europe’s reliance on gas supplies from Russia, along with troop build-ups along the shared border, to extract concessions over demands regarding Ukraine. The U.S. is suggesting it could respond to armed aggression by blocking Russia’s financial institutions from the SWIFT payment system. There have already been examples of cyber hacks paralyzing energy supplies, medical services and digital smart city infrastructure.

In his book The Age of Unpeace, author Mark Leonard asks “can globalization become weaponized?” I think he already had his answer. Any asymmetric imbalance between nations gives an opportunity for exploitation. As a current example, China has accused the small Baltic state of Lithuania of breaking its One China policy through its trading relationship with Taiwan. China is leveraging its position of mass manufacturer of global consumer goods to isolate the country. Companies from several EU countries that depend on Lithuanian supply chains are facing blockades at Chinese ports. The EU has little to throw back by way of response.

In 2020, Taiwanese companies were responsible for manufacturing an estimated 60% of the world’s microchips. As IoT in smart homes and workplaces accelerates, the demand for them will only grow. If the One China policy comes to fruition – unification of a single China – its domination of microchips would have very serious repercussions in the global economy.

Technology factors

The technology outlined earlier is more affordable and accessible to smaller businesses than global brand owners or their key B2B suppliers.

I also want to add Societal factors

Globalization has provided most benefit for shareholders, who are pretty much the only group of people with a say in how a company is run. Yet every business impacts on a wider range of stakeholders including employees, suppliers, the climate and sustainability conscious, and the small business ecosystems that rely on prosperous local economies. The swelling ranks of B Corps is testament to the number of businesses who no longer use economic performance as their prime metric. Bringing production nearer to consumer markets through deglobalization can reawaken a greater shared purpose between consumers, businesses and government. Other aims and benefits do not have to be subservient to profits, though of course there needs to be enough of a profit.

In his book The Great Transformation, the great Hungarian thinker Karl Polanyi wrote deglobalization is about “re-embedding” the economy in society, instead of having society driven by the economy.

The idea of such stakeholder capitalism, rather than just shareholder capitalism, is a key part of The Great Reset push. The phrase was first used in this context as the title of a 2010 book, The Great Reset, by American urban studies scholar Richard Florida. Four years later, at the annual World Economic Forum held in Davos, WEF’s founder and executive chairman Klaus Schwab declared he wanted to “push the reset button.” Since then, the image of a reset button has appeared on the WEF’s website.

So there are understandable motivations for deglobalization to bring distant supply chains back within national control, or at least within the sphere of fully trusted partners, and decouple from globalized production. In his 2017 book From Global to Local, the late Cambridge University economist Finbarr Livesey wrote that globalization as we know it was already long gone out of date, but the experts hadn’t noticed the shift to deglobalization.

0 Comments