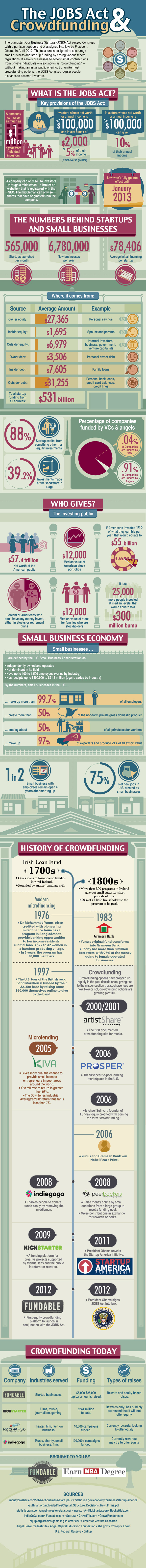

Crowdfunding is a way that businesses can seek money from a “crowd” to start-up, finance a new product, or expand their operations. Instead of pursuing big VC’s and investors, businesses pursue the crowd. The “crowd” pledges money to the effort – could be a start-up, cause or non-profit, in response to an appeal or request. The power of the “crowd” makes small donations significant.

In the U.S., there are two types of crowdfunding – reward-based and equity-based.

Reward-based crowdfunding: Funders receive a reward of some type for making a donation to a crowd-funded project. These rewards are predetermined and usually vary depending on the amount contributed. Kickstarter and Indiegogo are some of the reward based crowdfunding platforms.

Equity-based crowdfunding: Up until 2011 equity-based crowdfunding was not legal in the U.S. Equity-based crowdfunding allows people to invest, even small amounts of money, in projects and, in return, receive a small piece of ownership of the project, somewhat like buying stock. But with the new Jobs Act, passed in April, 2012, US is going to allow equity-based crowdfunding. Once the regulations are set in place, this development could prove a boon for U.S. small businesses, who are seeking capital during the economic recovery.

Fundable partnered with EarnMBA to put together an infographic on the JOBS Act and the history of crowdfunding.

0 Comments