Property investment is one of the four most common types of investments, alongside cash, bonds and shares. Of the four, real estate has been the best performing investment in modern history. Though through lack of access to sufficient funding, most people have been excluded from getting involved and enjoying the benefits. Real estate crowdfunding has democratized investing in property, and allows smaller players to invest alongside the biggest ones, often on the same terms.

Investing in real estate on a personal basis still usually consists of either buying a property to rent out, or buying one in need of repair, improving it and selling it at a profit – a “fix and flip.” Each method is time consuming, restricted to people with access to a “critical mass” level of funding, and is quite a singular activity. Though as with many other areas of business and trading, communication technology has enabled creating new and disruptive business models. In this case, real estate crowdfunding enables crowds of investors, who are most likely complete strangers to each other, to pool their resources and access new market opportunities.

How real estate crowdfunding works

Real estate crowdfunding is a creative investment strategy that is therefore becoming more and more popular. Numerous specialist crowdfunding platforms are online marketplaces where real estate management teams, or maybe property developers, aim to raise money to complete construction or refurbishment projects through showcasing them as investment opportunities. Individual investors gain access to numerous projects to choose from that offer attractive returns on investment that were previously available only to institutional backers, and they can each invest affordable sums that are way below the full purchase price of an individual property.

The investment strategy usually works in one of two ways. The first is that money is invested in bonds issued by the developer with fixed interest rates and repayment dates. This is effectively a case of peer-to-peer lending. The second strategy is that a company is formed for the lifetime of the real estate project, and backers buy a slice of equity in that company. In the equity route there are no fixed returns, but no cap on returns either. This means investors share more of the risk and reward. Experts oversee the projects, there are no call-outs to fix a flooded kitchen or a power failure, and no construction or repair bills to cash flow.

And if something prevents project completion, the real estate can be sold to mitigate losses (subject to debts incurred and perhaps preferential rights of other classes of investor or lender).

Through these methods, people can invest small amounts of money alongside, and frequently on the same terms, as billionaire investors such as Grant Cardone. It’s easy to do, small investors don’t need a lot of income to get started, and don’t have to take on any long-term responsibilities. Investing alongside Grant Cardone also gives them a buying power that comes with having crowdfunded a record-setting amount of money measured in the hundreds of millions of dollars.

How Grant Cardone achieved crowdfunding success

Real estate crowdfunding guru Grant Cardone didn’t have a privileged start to his career. At 21 he left school bankrupt and by 30 he was a millionaire. Today he is one a well-known entrepreneur and sales coach, plus CEO of one of the largest private real estate funds in the U.S., Cardone Capital.

His first real estate deal was in Texas. He got a loan to buy a property, and rented it out for $100 a month more than his loan repayment. He sold it after a few months and doubled the value of his equity. Then he bought more than one property. Then he bought larger properties with multiple units, so the impact of any temporarily empty units could be carried by the others. So long as occupancy levels covered the vacancy levels everything was fine. There were plenty more deals which had a high success rate, and the few that did not fully go according to plan or expectations provided some valuable lessons.

Along the way Grant met his wife Elena, a very successful business person in her own right. The two are an archetypal “power couple” and happy to share secrets of how they achieved their success through prioritization and a focus on targets.

Grant also runs a business mentoring company, Cardone Enterprise, which stages a major, three-day 10X Growth annual event. Each year, more and more audience delegates began to offer him their money to invest alongside his own in his projects. He formed Cardone Capital in 2018 to formalise the process of using other investors’ money within a crowdfunding set up, and it enabled letting other would-be investors know about the opportunities.

What success looks like

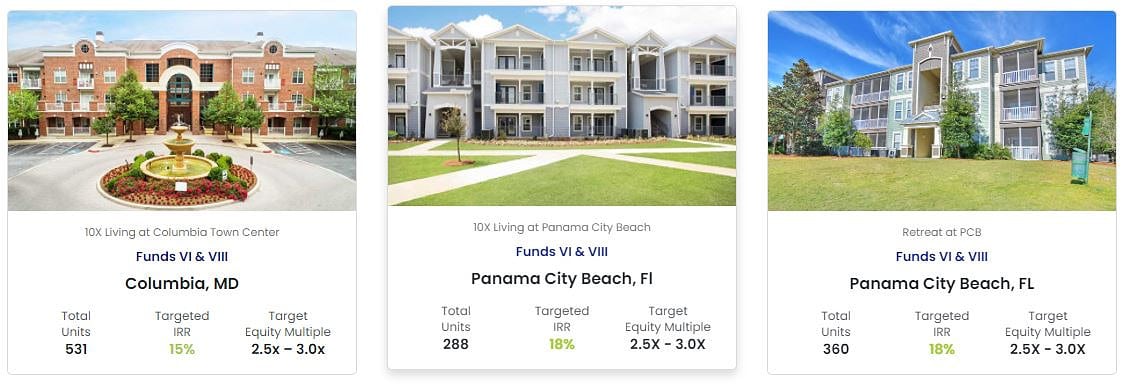

Today, investors can enjoy better returns than they would without access to Grant Cardone’s team with their accomplished skills and decision-making. And with their capital input, Cardone Capital can make more deals. Each property deal leverages the initial investment, so having more to invest accelerates growth. Cardone Capital has $2 billion of real estate under management, and the aim is for $10 billion. We wouldn’t bet against him!

0 Comments