Predicting crowdfunding success is a rapidly evolving field, and analysis of big data from various sources is becoming increasingly powerful for this purpose. An academic study concluded that the success of crowdfunding projects can be predicted by measuring and analyzing big data of social media activity, human capital of funders and online project presentation. This is likely to matter a lot more when raising funds for, or investing in, a privately owned business through equity crowdfunding than pre-ordering items through reward-based crowdfunding, though the techniques in this article can broadly apply to both forms. Here’s a checklist-style deeper dive into these three categories, with a shortlist of tools available to help accelerate any analysis.

1. Social media activity

Engagement metrics

Successful crowdfunding projects are powered by effective social media activity. Tracking likes, shares, comments, and mentions across platforms can reveal the level of public interest and potential virality of a crowdfunding project. Platforms like X/Twitter and Facebook offer valuable insights through hashtags and sentiment analysis.

Community interaction

Monitoring how the project team interacts with potential backers (replies, answers, discussions) can indicate their commitment and ability to build relationships.

Influencer outreach

Analyzing endorsements and mentions by influential figures in relevant communities can gauge potential reach and trust among target audiences.

Here are some AI tools suitable for analyzing social media activity.

Brand24 monitors mentions and sentiment across social media platforms, providing insights into audience engagement and brand perception.

Buzzsumo analyzes content performance and identifies influencers in your niche, aiding in targeted outreach and campaign promotion.

Meltwater offers competitor and industry analysis alongside social media monitoring, allowing you to benchmark your campaign and adapt strategies.

SparkToro analyzes X/Twitter data to uncover audience interests, demographics, and psychographics, helping both project leaders and potential backers recognise the types of people a crowdfunding project ought to be targeting.

2. Human capital of funders

An examination of the types of people, and even specific individuals who are prominent backers, is a valuable of component predicting success through crowdfunding data analysis.

Network analysis

Crowdfunding platforms only get paid by the projects that succeed. As an indicator of likely success, equity crowdfunding platforms require projects to have already secured a significant level of backing, generally at least 30% of the crowdfunding target. This money can come from VCs, family funds, or angel investors. If the information on lead investors is not available from the crowdfunding platform then make a point of asking the project leader(s). Mapping the connections between cornerstone backers can identify clusters of potential supporters and predict network effects (spreading enthusiasm through existing connections).

Past backing history

In addition to lead investors, the cornerstone backers, there are others who show themselves to be larger backers. Similar to lead investors, evaluate their track record, past funding activities, and success rates of supported projects to draw your own conclusions as to their expertise and potential influence. There are backer directories available that have information on regular and super backers on Kickstarter and Indiegogo.

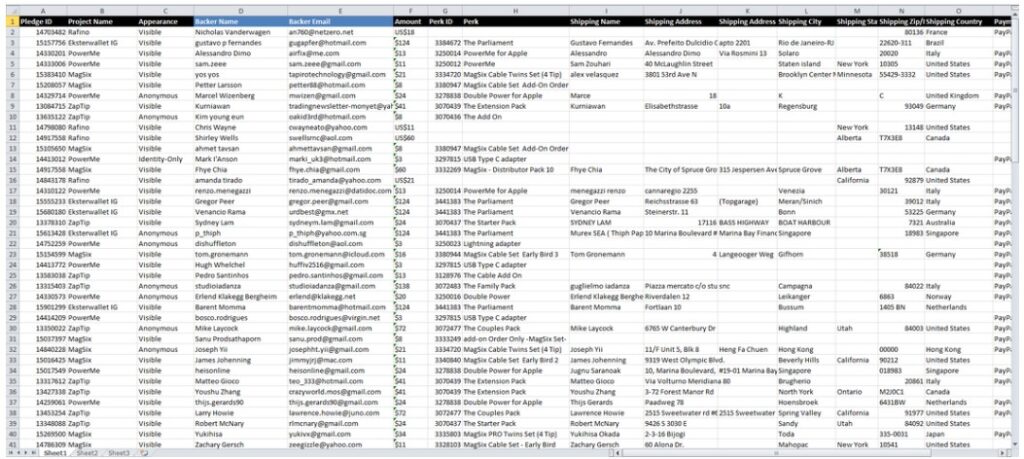

An extract of a backers database. Source: USCOMPANIESLIST.COM

Demographic and psychographic profiling

Understanding the interests, values, and social identities of early backers can help refine targeting strategies and messaging for the broader audience. Kickstarter, for example, provides a Kickstarter Backer Survey tool to project creators. A survey allows project creators to gather valuable insights and information from their early backers, enabling them to better understand their audience and thus refine and improve the project to align better with backer expectations.

3. Online project presentation

This third element of using data to predict crowdfunding success is more restricted to the teams running their crowdfunding projects. The metrics will not be available for potential project backers to examine.

The decision-making process of crowdfunding project backers is likely to differ from that of professional investors as the amounts involved can be relatively small. As a consequence, backers may rely more on first impressions compared to a longer deliberation when more is at stake.

Campaign content analysis

Analyzing the project description, visuals, videos, and overall storytelling approach can reveal the persuasiveness, clarity, and emotional connection with potential backers.

Landing page optimization

For a crowdfunding project team, measuring click-through rates, conversion rates, and engagement with campaign materials can inform A/B testing and optimization of the online presentation.

Goal setting and stretch goals

Setting realistic yet ambitious funding goals, with well-defined milestones and rewards (if appropriate in an equity crowdfunding project), can impact backer confidence and commitment.

Here are four tools that crowdfunding project teams can use.

Copy AI generates AI-powered marketing copy and slogans for your campaign page, ensuring clear and persuasive messaging.

Unbounce offers a landing page builder with A/B testing capabilities, allowing users to optimize your campaign page for maximum conversions.

Hotjar provides heatmaps and recordings of user behavior on your campaign page, helping you identify areas for improvement and optimize the user experience.

Canva is widely used, and offers AI-powered design tools and templates for creating visually appealing campaign materials like infographics and social media posts.

Combining data sources to predict crowdfunding success

The real power for crowdfunding teams lies in combining insights from all three areas. Machine learning algorithms can analyze vast amounts of data and identify patterns and correlations that predict campaign success with greater accuracy, for both project teams and backers. For example, identifying correlations between specific social media engagement patterns and the demographics of successful backers can inform targeted outreach strategies.

However, it’s important to remember that these methods are not foolproof, and external factors like economic conditions or competitor activity can still play a role. Additionally, ethical considerations like data privacy and responsible use of algorithms need to be considered.

The key takeaway is that big data analysis holds immense potential to predict crowdfunding success, but it should be used as a tool for informed decision-making, not a guarantee of success. By combining data-driven insights with creativity, passion, and a strong understanding of your target audience, a crowdfunding project leader can significantly increase the chances of a successful crowdfunding campaign. Investors can employ similar crowdfunding data analysis techniques to improve the return on investment across their whole portfolio.

0 Comments