The US crowdfunding sector has grown far bigger and wider than the reward projects initially associated with Indiegogo and Kickstarter. Groundfloor is a real estate investment platform that enables everyday Americans to have a fractional involvement in short-term, high-yield real estate deals alongside high net worth individuals and professional and institutional investors. And as of January 9 2018, Groundfloor now operates across the country in all 50 US states.

For borrowers, the property involved provides security for the loans provided by Groundfloor so they don’t require personal guarantees. Loan approval is faster, with interest rates tied to a sliding scale that reflects risk.

We were fortunate to catch up with Brian Dally, Co-Founder and CEO of Groundfloor and he gave us some market background and brought us up to date with some recent and possible future developments.

Q. Crowdfunded investment opportunities in the UK – subject to self-certification as an ‘experienced investor’ – have always been open to everyone. For those unfamiliar with the US regulations, it’s a bit stricter, isn’t it? What are the formal distinctions between accredited and non-accredited investors?

In the United States, to be considered an accredited investor, one must have a net worth of at least $1,000,000, excluding the value of one’s primary residence, or have income at least $200,000 each year for the last two years (or $300,000 combined income if married) and have the expectation to make the same amount this year. The term “accredited investor” is defined in Rule 501 of Regulation D of the U.S. Securities and Exchange Commission (SEC).

Groundfloor offers real estate investment opportunities equally to both non-accredited and accredited investors.

Q. Another regulatory issue was that to operate in all 50 states, Groundfloor had to have Tier 2 status. Can you please explain what this is and what it involved to achieve it?

On January 9, we announced that Groundfloor’s product offering was qualified by the U.S. Securities & Exchange Commission under Tier II of Regulation A. This was an important milestone not only for us as a company, but for individual investors nationwide as well.

Let me take a moment to put the significance of this in to the context of Groundfloor’s history. Our first offering four years ago was available only to residents of Georgia. In 2014 and 2015, we prototyped the original version of Groundfloor under the innovative Invest Georgia Exemption. After 18 months of regulatory and product development, we became the first issuer with a security like ours to qualify under Regulation A. For the past two years, we operated under Tier I of Regulation A, which allowed us to offer securities with concurrent federal and state-level qualification.

Our work with state and federal regulators made our product offering and our company better. Still, two-thirds of the U.S. investor population were left out. We have always been eager to bring Groundfloor to the rest of the country. In 2017, with our lending operations ready to supply more than the Tier I offering limit allowed, we decided to request qualification under Tier II, tripling our addressable market and paving the way to start offering our securities to over 200 million individual investors in all 50 U.S. states.

The road we’ve chosen hasn’t been an easy one. The regulatory disclosures and reporting requirements to which we’ve submitted have sometimes slowed us down and imposed high operational and legal costs. But nevertheless, we’ve always stayed true to our commitment to serve non-accredited and accredited investors alike. We believe a more open, more accessible, broad-based and level investment playing field benefits individual investors, the projects they finance and the economy as a whole.

Q. Equity crowdfunding projects tie investors’ money in for an unknown number of years. Groundfloor operates on shorter timescales to match real estate completion dates, doesn’t it. What’s been the overall ROI rate you’ve achieved for investors since Groundfloor started, and the average period of time between investing and closing out?

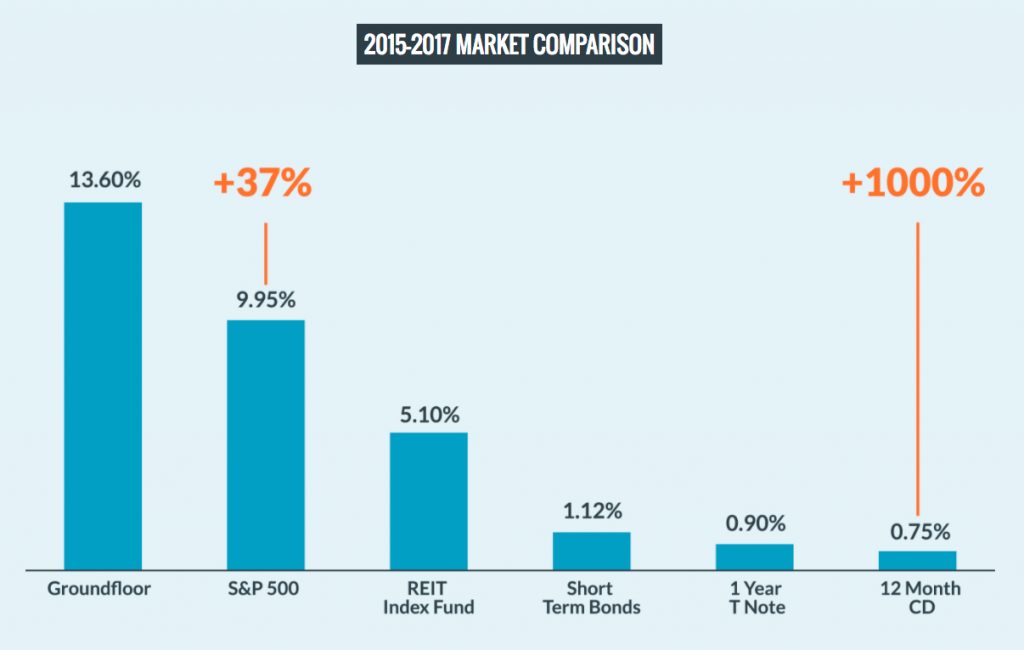

Through investing in fix and flip real estate loans, Groundfloor investors have earned 13.6% per year from 2015-2017. That’s 37% better than they would have made in the stock market that year, and over 1000% more than they would have made in a CD or savings account.

The average time period from investing to closing out through Groundfloor is 8-9 months.

Q. In your risk analysis of the projects that borrowers bring to Groundfloor, do you use any artificial intelligence techniques or methods, or is it experienced people solely using their know-how to weigh up the odds?

Groundfloor uses both AI and its professionals’ experience and judgment applied to numerous methods and practices. The AI component is focused on AVMs (automated valuation model) and a proprietary risk rating model.

Q. What are those due diligence checks Groundfloor makes to protect investors’ money?

Groundfloor’s due diligence for both underwriting and asset management are informed by professionals with decades of real estate investment experience. Our Loan Operations team is led by Rich Pulido, Senior Vice President of Lending and Risk Management. Rich joined Groundfloor after a 28-year career with Prudential’s commercial real estate investment unit. His broad experience includes both debt and equity asset management, development and portfolio management roles. At Prudential, he led the special servicing (problem loan) group responsible for a $50 billion commercial mortgage portfolio through the Great Recession.

When underwriting a loan, Rich and his team look at myriad factors, and each loan is graded according to these factors.

- Extensive diligence on the deal principal(s) is conducted, including background and credit checks, and verification of fix and flip experience.

- Every loan is subjected to property-level diligence including obtaining an interior inspection appraisal signed by a licensed appraiser, at least one supporting automated valuation model (AVM).

- A review of the chain of title is performed before obtaining clear title and related title insurance.

- Based on the extent of the contemplated renovation work, additional diligence, such as an engineer’s and/or contractor’s review of the budget as well as a required permit review may be undertaken.

- Various metrics such as loan to value ratio (LTV), loan to cost ratio (LTC), initial loan exposure at closing and deal profitability are all considered in the underwriting process.

- Finally, portfolio considerations such as overall exposure to the principal and submarket are also considered.

Once a loan has closed and the borrower is requesting construction draws, each draw request must be validated by a property inspection report which includes photos and an assessment of work completed to the budget. The inspections are conducted by a national firm that specializes in providing lender services.

Further, borrowers are required to regularly provide project updates and may not receive additional draws if Groundfloor is not kept current on the project’s status. These practices enable Groundfloor to properly manage and track a project and intercede should heightened lender attention be required.

For a mini case study on how we choose our loans and our principals, please see this blog post: http://blog.groundfloor.us/groundfloorblog/behind-the-curtain

Q. As more investors reap the benefits of investing with Groundfloor, do you feel that US regulators are moving at all toward easing some of the restrictive conditions that apply to non-accredited investors?

Recently, the US House of Representatives has passed legislation that will increase the Reg A+ cap to $75 million from the current $50 million amount. By raising the exemption to $75 million, the crowdfunding rule may be able to help a broader number of smaller firms raise needed growth capital. The bill will now go to the Senate for discussion.

Thank you Brian. In closing, Groundfloor has been running its own equity crowdfunding campaign. The current round is due to close April 6th 2018 and by April 2 they had raised over $3.3m from over 1,500 backers for just over 10% of the business. There will be a further round starting April 9 for nearly another 5% equity, the total target is to raise $5m. The funds raised will enable expansion in adjacent markets like multifamily acquisition and renovation, and non-bank new construction, which will greatly expand the market size addressed by Groundfloor.

Have you some real estate crowdfunding experience you’d like to share with us?

0 Comments