Buying shares in privately-owned businesses is a risky and a relatively illiquid investment. Early critics of equity crowdfunding as an alternative source of early-stage business funding were keen to point out the long time scales that investors in startups would have to wait to enjoy a return. No matter how much personal circumstances changed for any individual investor, their money was going to remain tied up until the business(es) they invested in exited by completing either a trade sale or an IPO (initial public offering). A growing number of secondary markets for equity in privately-owned businesses is changing the situation. Retail investors can now plan and execute their own exit strategy. This blog takes a closer look at secondary markets for equity crowdfunding shares.

Market size

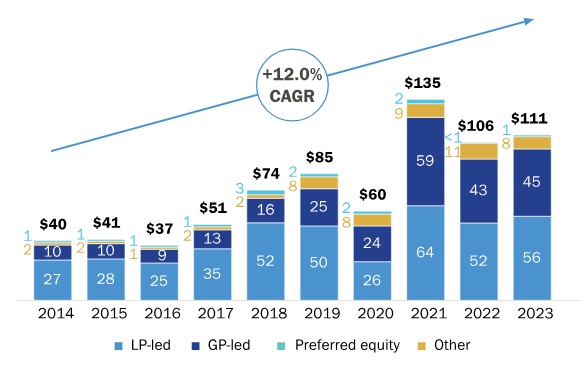

Transactions on secondary markets rose from $51 billion in 2017 to $135 billion in 2021 and closed at $111 billion in 2023, its second highest ever figure, according to data from Campbell Lutyens.

Annual Secondary Market Values

Source: Campbell Lutyens

Main advantages of secondary markets

Increased Liquidity

Private company shares can’t be easily bought or sold, which is usually described as being illiquid. Secondary markets provide a platform to exit investments before a traditional exit event (IPO or acquisition) unlocks the tied-up capital. With the current depressed financial markets cooling the number of IPOs, and VC returns still in the doldrums, secondary markets are commanding extra attention.

Early Realization of Gains

An investor who believes a company’s value has increased can go to a secondary market to sell all or some of their shares and capture a financial gain prior to a potential IPO or acquisition/trade sale.

As an example, in February 2024 the payment platform Stripe announced it had reached an agreement with its investors to provide liquidity to current and former employees in a share purchase that valued the company at $65 billion. While that was down from the $95 billion valuation the company enjoyed in 2021, it was still a big rise from their last primary round that valued the fintech business at $50 billion in 2023.

Portfolio Diversification

Secondary markets can help investors diversify their portfolio by enabling them to sell existing holdings and invest in different opportunities.

Improved Risk Management

If an investor’s investment thesis changes, or funds are needed elsewhere, secondary markets offer an option to manage risk by exiting the position.

Increased Investment Appetite

The existence of a secondary market can make private equity investments more attractive to some investors who are hesitant due to the typical illiquidity. On some equity crowdfunding platforms, businesses raising funds for equity have to confirm if they will allow their shares to be traded through secondary markets, or not.

Secondary market limitations

Whilst secondary trading offers a valuable tool for investors in private companies, providing liquidity, managing risk, and potentially capturing gains, understanding the limitations is essential before participating.

Lower Valuation

Secondary trades often happen at a discount to the perceived future value of the company, because the buyer isn’t getting the maximum benefit of a potential future IPO.

Limited Availability

Secondary markets for private companies are not always readily available and may only exist for specific companies or asset classes.

Less Regulation

Secondary markets may have less stringent regulations compared to public exchanges, so it’s crucial to carry out due diligence on potential buyers.

Popular secondary marketplaces

UK and Europe

The UK equity crowdfunding sector is dominated by Crowdcube and Seedrs, who between them have over 80% of the market.

Crowdcube has partnered with the data platform Crunchbase, and its Cubex secondary market provides easy access to data on more than 250,000 privately-owned companies throughout Europe. This gives investors and shareholders an opportunity to first discover and research potential investments, and then express an interest to buy or sell shares in private European companies of their choice. If enough interest is registered in a given business, Crowdcube will investigate a possible transaction and notify interested parties when a sale goes live.

1,063 shareholders in Freetrade sold £5.8m of shares through Cubex in 2021. This secondary share sale saw early investors enjoy a 47x (4,670%) return on investment without having to wait for a company exit.

The Seedrs (rebranded as Republic Europe in July 2024) secondary market allows founders, investors and early employees who had received equity to monetise their shares without having to wait for an IPO, trade sale or other exit event. Seedrs made this move in partnership with Capdesk, a trading platform for anyone with equity in a private company. In a mutually beneficial collaboration, any business listed on Capdesk can sell shares via Seedrs’ marketplace, and anyone in Seedrs’ investor network can consider investing in many thousands more companies than have been featured on the Seedrs platform.

A Selection of Equity Available at Seedrs’ Secondary Market,

from bamboo tissues to a football club

Source: Seedrs

Capdesk’s founder, Christian Gabriel, had previously worked at the FundedByMe equity crowdfunding platform in Denmark. It gave him first-hand knowledge of everyday investor and startup finance pinch points that Capdesk then set out to resolve.

Outside of secondary markets accessed through these two crowdfunding platforms, Funderbeam is a London-based international share trading platform for equity in privately-owned companies – however or wherever the equity was acquired. Companies can raise funds through the platform outside of a structured crowdfunding project. The minimum investment in any company that is fundraising is typically set at between €250 and €1,000. Buyers and sellers in the secondary market can post orders of flexible quantities and values.

Venture Wave, an Irish-based venture private equity group, acquired a majority share of Funderbeam in May 2023 with a view to international expansion.

Campbell Lutyens Secondary is a private equity firm specialising in secondary transactions, and can be a good resource for global secondary market opportunities.

U.S. and beyond

U.S. equity crowdfunding platforms have not developed secondary markets as far as in the UK. The Wefunder site, the largest platform of its kind in North America, says this:

“While there is no public market for your investment, you may sell your stake to another investor if they are a family member or an accredited investor during the first year of your investment. After the first year, you may sell your stake to any interested buyer.”

In either case, the equity holder has to find a buyer first, and Wefunder will set up the legal transfer documents. During this process, the equity holder also needs to arrange the transfer of funds between themselves and the buyer, as Wefunder does not assist with this step.

However, the second largest U.S. equity crowdfunding platform, StartEngine, does have a limited secondary market. StartEngine Secondary allows investors to trade with each other in a peer-to-peer marketplace. Sellers can post offers to sell a specific number of shares by setting a minimum price. Buyers can post offers to buy a specific number of shares by setting maximum price. If a match is made, then the trade is executed. There is a 5% fee for sellers.

Here is a selection of other secondary marketplace providers operating in the United States and internationally, there are more available.

Forge Global, a prominent platform focused on secondary transactions for private technology companies, particularly growth-stage ventures, now serves investors, shareholders and financial institutions in the United States, the UK and Europe.

EquityZen is a US-based platform that has expanded into Europe, allowing accredited investors to buy and sell shares in private companies. While the focus might be on US deals, it’s worth checking their offerings for European opportunities.

Lexington Partners is a global leader in secondary transactions, and invests in established private equity funds and can offer liquidity solutions to investors holding private company shares.

Goldman Sachs Secondary Market Group. This prominent U.S. investment bank has a dedicated team focused on secondary transactions in private equity, including opportunities in European companies.

Keep up-to-date

The Crowdfunding Portal website tracks crowdfunding industry news and regulations and might cover developments in secondary markets.

Fintech Finance News is a news outlet focused on alternative finance, including secondary markets.

National Private Equity Association (NPEA) – US based, offers resources on secondary markets (general information).

European Venture Capital Association (EVCA) – look for reports on secondary markets in Europe (though the focus may be on VC investments).

0 Comments