Last decade was about YOU – the next decade will be about WE.

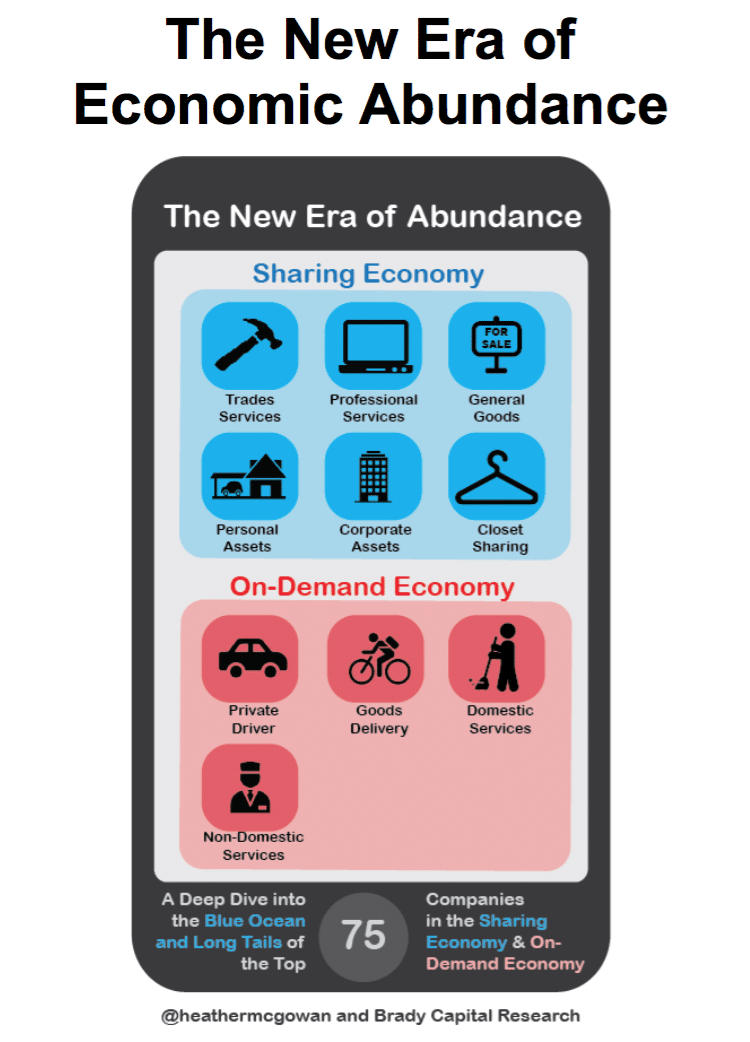

Welcome to the new world of what Epi Ludvik Nekaj refers to as “Crowd Capital”. Just as the democratization of content in the past decade led to structural disruption in media-related sectors, the emerging democratization of physical and human capital by Sharing/On-Demand Economy companies will lead to structural disruption over a much wider range of sectors. This will result in radical transformation of the corporate landscape as “crowd capital” creates a new form of commerce, shifting us from the Traditional Era of Scarcity to a New Era of Economic Abundance.

In my two decades of working as an Equity Analyst, I have never been as fascinated as a space as the Sharing/On-Demand Economy. For the past year I have been trying to figure out how Airbnb and Uber (which are now valued at $25.5 billion and $51 billion) have been able to achieve accelerated rates of value creation. And I have realized it is because these companies are defying economic principles of scarcity. So I coined the term “copianomics” (which I define as the science of choice under abundance, as opposed to scarcity) to explain how the following economic forces act as growth catalysts:

- Long Tail[1] of Supply – Inventory growth is not limited by traditional time or capital constraints as the companies are accessing a long tail of under-utilized/latent assets, goods and services.

- Blue Ocean[2] of Demand – Revenue growth is not limited by existing demand constraints as companies can expand their Total Addressable Market (TAM) beyond traditional categories by accessing new blue oceans of market demand.

It is important to recognize that companies like Airbnb and Uber are not just playing by different rules of game – they have become the mastermind of the game itself.

For example, can you imagine analysts’ reaction on Hilton Worldwide’s next quarterly conference call if management announced plans to spend $170 billion over the next five years to add 12,000 hotels? This would be infeasible given Hilton’s market capitalization is only $25 billion and it took it nearly a century to reach its current base of 4,300 hotels. But for some insane reason, Airbnb’s management believes it can defy traditional economics – it is forecasting its revenue to grow over 10 times from $900 million this year to $10 billion by 2020, which we calculate implies the addition of 12 million listings, the equivalent of 12,000 hotels.

Did you know that in San Francisco, Uber is generating driver revenue of $500 million a year, in excess of three times the $140 million revenue of the taxi market industry. Not only has Uber emerged from left-field as a disruptive threat to both the taxi industry’s core activities and its core assets (i.e. the premium-priced taxi medallions which created artificial scarcity), but it has created new blue oceans by expanding its Total Addressable Market (TAM) to non-customers that used to take public transport, rent, or even own vehicles.

Not surprisingly, capital is starting to flow. I calculate the top 75 Sharing/On-Demand companies have raised $15.3 billion to-date, with $10.8 billion, or over two-thirds of this, being raised in the past six quarters by the three heavyweights: Uber, Airbnb and Lyft. The 72 remaining companies have raised a total of $3.8 billion, with the median raise at $26 million. With the upcoming IPOs of Airbnb and Uber, I expect investor interest will continue to rise. Asides from Airbnb and Uber, I see the greatest opportunities for growth and value creation in the Corporate Asset Sharing vertical – discovering new blue oceans through unbundling corporate assets by time, space, and use –and; the Professional Services vertical – building empowering platforms that enable professionals to escape the cubicle and monetize their expertise.

For more insights into “The New Era of Economic Abundance”, please feel free to download my in-depth research report and/or watch the 20-minute presentation I recently gave at the Collaborative Economy Conference in San Francisco.

Download the In-depth Research Report on “The New Era of Economic Abundance.”

[1] The Long Tail: Why the Future of Business is Selling Less of More, Chris Anderson, Hyperion, July 2006

[2] Blue Ocean Strategy: How to Create Uncontested Market Space and Make Competition Irrelevant, W. Chan Kim & Renee Mauborgne, Harvard Business Review Press, February 2005

0 Comments