Our Virtual Crowd Summit on Crowdfunding (27 August 2020) took a comprehensive look at both reward and equity crowdfunding with insights shared by international experts. This article sums up some key insights in to equity crowdfunding. The reward crowdfunding element of the event is covered here.

Raising capital through equity crowdfunding

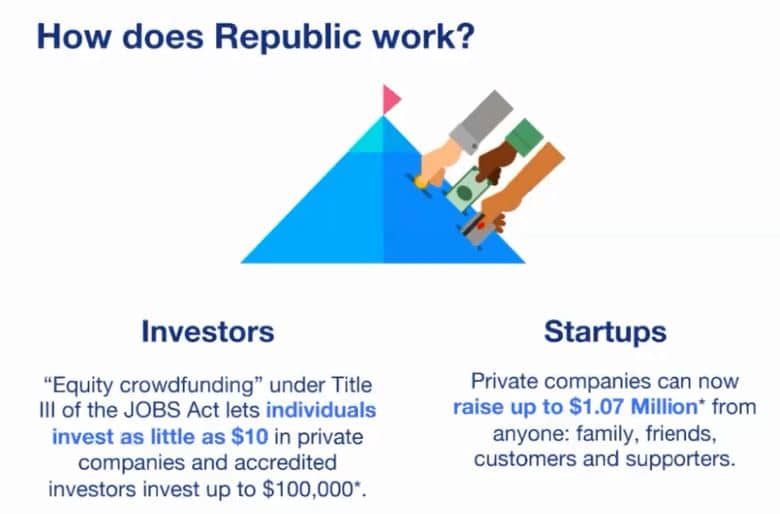

Andrew Zhang of Republic, a U.S. equity crowdfunding platform, took us through the essential structure of a money-for-equity campaign.

They have certainly hosted enough projects to have built up a wealth of insight and experience. Republic has enabled over 150 companies to raise a total of $45 million. Last year the average raise was $500,000. Most of the investors were non-accredited, and the raises were capped at a top limit of $1,070,000 by SEC regulations.

Equity Crowdfunding

Equity crowdfunding can run alongside other funding mechanisms that between them can bring in a maximum of $5m.

There is a strict vetting process to ensure that only the best opportunities are put to Republic’s database of investors: under 1% of all applicants end up launching a campaign.

However, keeping to the theme that equity crowdfunding has democratized the process of funding a startup business, 40% of project leaders have been women, and 20% have been Black or Latinx.

Funding generally comes from four sources: friends and family; people who know the business – customers, suppliers, other stakeholders; Republic’s network of investors; new supporters brought in by marketing activities.

The usual timeline is for a three to four month campaign from going live online to issuing shares to new shareholders. Though prior to this there are issues including arriving at a company valuation, preparing marketing materials, and pre-selling to reach c. 30% of the financial target. Pre-selling ensures a campaign starts with a bang and not a whimper, and gives it dynamic momentum that attracts investors looking for a home for their money.

Lessons from 10 years of crowdfunding in Europe

Christin Friedrich, CEO of the Innovestment platform in Berlin, is also Chair of the European Crowdfunding Network.

Key lessons include the realization that at whatever stage of a company’s growth, in addition to raising money, successful crowdfunding involves, builds and strengthens communities. Though in an increasingly competitive environment this requires expert communication skills.

Key lessons include the realization that at whatever stage of a company’s growth, in addition to raising money, successful crowdfunding involves, builds and strengthens communities. Though in an increasingly competitive environment this requires expert communication skills.

An equity crowdfunding project should make it clear what it is asking for; what the organization raising the money hopes to achieve; and who will benefit. Any funder can go on to become a customer, an advocate, or a supplier. So keep communicating after the crowdfunding closes, share news about your progress through achieving milestones or report on KPIs.

As well as improved professionalization of all aspects of the process, regulations are adapting to crowdfunding being a global practice. Funds need to flow freely to encourage cross-border financing, though authorities have to be aware of laundering. European harmonisation through the ECN will ease cross-border payments from outside the EU – which from 1 January 2021 will include the UK.

Retail investor access to VC deals

Equity crowdfunding is often described as having democratized access to investment funds for startup owners who do not mix in the same circles as high net worth individuals and VC managers. In the same way, equity crowdfunding has opened up opportunities for retail investors to invest in private companies, sometimes alongside institutional backers.

Jonathan Medved is CEO of Israel-based OurCrowd. As the country’s biggest VC investor, he said their links with crowdfunding are becoming more stretched and tenuous than before, though they still allow individuals to piggy-back on their VC investments. For a management fee and a 20% carry-over on profits, retail investors can enjoy the same pre-IPO terms as a VC. Half of OurCrowd’s investment deals are in Israeli businesses.

Jonathan Medved is CEO of Israel-based OurCrowd. As the country’s biggest VC investor, he said their links with crowdfunding are becoming more stretched and tenuous than before, though they still allow individuals to piggy-back on their VC investments. For a management fee and a 20% carry-over on profits, retail investors can enjoy the same pre-IPO terms as a VC. Half of OurCrowd’s investment deals are in Israeli businesses.

OurCrowd’s prospects are looking good. Their investor network includes 50,000 U.S. accredited investors. Jonathan is delighted the U.S. SEC (Securities Exchange Commission) is relaxing its stringent rules on who is allowed to invest, and how much they can invest, through crowdfunding projects. Professional qualifications can now replace former demarcations based on income or savings definitions. And smaller businesses will be able to raise more than the current cap of $1,070,000.

Also, a recent normalisation of political and trade relationships between Israel and the United Arab Emirates has the potential to unleash a torrent of investment capital, perhaps as much as half a billion USD in the first 12 months.

Crowdfunding for Policy Makers

Author and management consultant Tim Wright, of TwinTangibles, closed the event with a session based on insights gained from co-authoring a recently published book “CROWDASSET, Crowdfunding for Policy Makers.” The book looked at crowdfunding from a variety of perspectives, given that policy makers can represent the interests of diverse stakeholders.

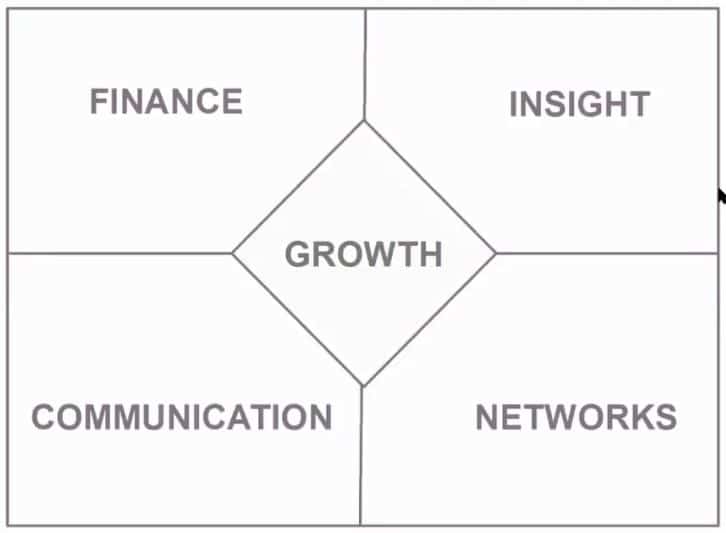

His visual device representing the core benefits of a crowdfunding campaign relates to core policy maker interests. In gaining a better understanding of what is of key concern to policy makers, crowdfunding project leaders can better ensure their campaign is fit to succeed.

Naturally, the key element of the whole exercise is that businesses want to grow. For that they need Finance, which in equity crowdfunding is achieved by selling part-ownership of the company. This aspect is overseen by financial regulators and authorities that ensure compliance with financial regulations. National tax regimes differ on how they treat the funding received, cross-border investing is scrutinised for possible money laundering, and the U.S. has an added complication of different rules that apply to accredited and non-accredited investors.

Some countries still bar equity crowdfunding in the interests of protecting unsophisticated investors from possible financial harm, including India.

Crowdfunding also provides Insight to company founders through receiving feedback from people on the nature and structure of the business, validation of the value put on the business, and feedback on the proposed products or services to be delivered. Business trading standards authorities, as an example, would be keen to know that any products offered by firms using crowdfunding meet statutory minimum requirements.

Good Communication is vital to succeed. This covers the marketing activities, raising awareness and stimulating sales. Most countries have extensive regulations on what can and can’t be said about crowdfunding opportunities, which can differ from one to another. So a crowdfunding campaign can’t always be picked up from one country and then run again in another.

Networks relates to a business’s customers, suppliers, supporters (who may not always be customers), and social media followers. Trading and Advertising authorities would once again be involved here.

And finally, there are also the vested interests of the crowdfunding platforms themselves, who are often members of their own professional trade representation and lobbying group. Such groups include the UK Crowdfunding Association, European Crowdfunding Network, National Crowdfunding & Fintech Association (NCFA) in Canada, and Bundesverband Crowdfunding eV in Germany.

The breadth of interests and responsibilities of related policy makers is thus extremely wide.

Tim Wright’s new book, CrowdAsset, is available now at www.worldscientific.com.

0 Comments