You can’t look in the news today without some Bitcoin enthusiast or some dumbfounded reporter trying to make sense of cryptocurrencies. It’s seemingly replaced Game of Thrones as the subject of every coffee shop conversation, yet very few actually understand the technology beyond a simple “yeah, it’s the future.” Even the foundational information: “what is the difference between blockchain, cryptocurrency, and Bitcoin?” gets lost in a sea of speculation, greed, and exuberance. Understanding them can provide a new class of investments while even those who prefer to keep their money away will benefit from understanding this new wave of approaching technology and Bitcoin value.

The Basics

Bitcoin and blockchain are commonly confused, but Bitcoin was simply the first implementation of blockchain technology. Bitcoin is to blockchain what Google is to the internet, or apples are to fruit. But in the exploding industry of cryptocurrencies, one of the biggest challenges is understanding not only Bitcoin’s relevance, but blockchain’s significance as well.

Blockchain

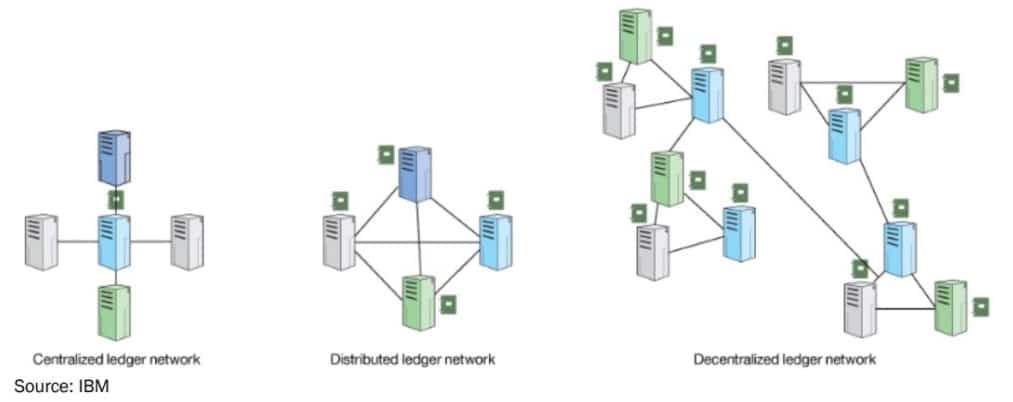

Blockchain, put simply, is a new way of decentralizing information. The technology isn’t new; decentralized computing has been studied for years, but Bitcoin succeeded in accomplishing that which many had failed to do before. Bitcoin, beginning with its Genesis Block, succeeded in creating digital scarcity. Unlike your Facebook profile, that Ed Sheeran YouTube video, and those Hawaii pictures you finally uploaded, code can be copied. Hard drives can be copied. Anything digital can be copied. Creating a currency represented by lines of code was not feasible. If code were to be copied, more bitcoin would be created. That doesn’t serve well for the future value of a currency. And when Bitcoin’s anonymous founder, Satoshi Nakamoto, published the premise of Bitcoin, he employed a well-recognized economic principal: Scarcity equals value. If Bitcoin should have value, then scarcity would be key.

Bitcoin

Satoshi Nakamoto utilized blockchain technology to create this scarcity. Bitcoin wouldn’t be a line of code. It wouldn’t be something that could be copied or  stolen. Bitcoin would simply be a recording of transactions in a ledger. Just as a ledger records transactions for banks and ensures that the bank always maintains a record of account balances, Bitcoin’s ledger would do the same.

stolen. Bitcoin would simply be a recording of transactions in a ledger. Just as a ledger records transactions for banks and ensures that the bank always maintains a record of account balances, Bitcoin’s ledger would do the same.

However, instead of the ledger existing within a central entity — with all the associated risks — it would exist collectively on all the computers in the network. The ledger would record all the incoming and outgoing transactions for every address in the network, and people would use cryptographic keys to prove that they had ownership over the Bitcoins in that address. Changing the ledger would require network consensus which an incentive model would ensure only happened when legitimate ledger changes were proposed. Thus, bitcoin couldn’t be copied, and scarcity would be ensured.

The second principal Satoshi looked to solve was how to avoid double spending. Money being spent needs a time stamp. We need to know which transactions happened first, and which ones last. Without this, people could effectively spend the same bitcoin twice, sending out two identical transactions and receiving goods for both. That’s similar to what people do when they bounce checks, spending money they have already spent. The blockchain would solve this.

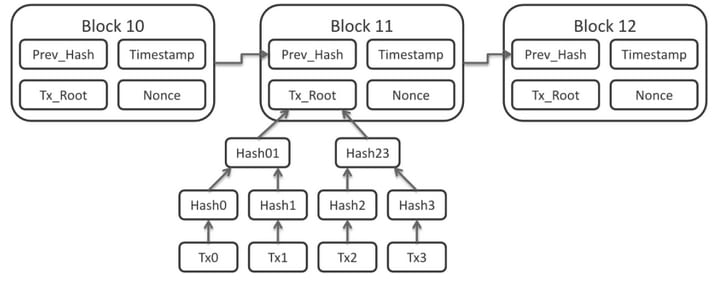

A system called mining (see explanation below) would order the transactions and publish groups of them in what are called “blocks.” Newly published “blocks” would reference every historical block through a system of hashes (a cryptographic solution). Any change to one block would corrupt every block in front of it. That’s why Bitcoin transactions grow more secure the lower in the chain they are. The linked connection of transactions would be shared amongst the computers in the network and would act as the decentralized ledger, maintaining a history of every Bitcoin transaction, protecting the network from attack, and preventing double spending.

What is Mining Cryptocurrency?

Bitcoin introduced the idea of a cost to operate the network. This would dis-incentivize spam transactions and create security for the network. He designed an intricate system that would result in a competition to “publish” blocks. Those who competed and used their computational power to publish blocks would be known as miners.

Bitcoin introduced the idea of a cost to operate the network. This would dis-incentivize spam transactions and create security for the network. He designed an intricate system that would result in a competition to “publish” blocks. Those who competed and used their computational power to publish blocks would be known as miners.

First, the technical explanation of how mining works: With every block there would be a known hash output. Miners would guess inputs, in the form of a number (or a nonce) and input it with the ordering of transactions. Nonces that produced a number below the desired output would have a valid block and would subsequently publish the block to all the other miners. That block would be placed into the blockchain, the next competition would start, and the successful miner would be rewarded with newly “minted” bitcoin – a reward for their efforts. Lowering the value of the known output would increase the mining difficulty.

Next, the simple explanation: Included with every block — or ordering of transactions — would be a puzzle. Solving this puzzle would result in the miner “discovering” a valid block. That valid block would be put into the blockchain and he or she would receive newly minted bitcoin for their efforts. Because solving this hash – or puzzle – was so difficult, all that computers could do was guess numbers as quickly as possible. Obviously, the faster the computer, the more likely the miner would solve the puzzle and receive the reward. Miners would create more powerful computers in a competition, thus creating a more secure network. Since changing a transaction required network consensus, producing an illegitimate transaction required harnessing enough computing power to be able to create consensus on one’s own (51%). As competition for computing power grew, so would the difficulty in obtaining 51% of the network’s computational power.

Next, the simple explanation: Included with every block — or ordering of transactions — would be a puzzle. Solving this puzzle would result in the miner “discovering” a valid block. That valid block would be put into the blockchain and he or she would receive newly minted bitcoin for their efforts. Because solving this hash – or puzzle – was so difficult, all that computers could do was guess numbers as quickly as possible. Obviously, the faster the computer, the more likely the miner would solve the puzzle and receive the reward. Miners would create more powerful computers in a competition, thus creating a more secure network. Since changing a transaction required network consensus, producing an illegitimate transaction required harnessing enough computing power to be able to create consensus on one’s own (51%). As competition for computing power grew, so would the difficulty in obtaining 51% of the network’s computational power.

This concept is known as Proof of Work. Miners do work in the form of paying for electricity and running powerful machines to solve puzzles. When they find a solution, they publish it. Work needs to be done to find a solution. Thus, having a solution to that puzzle is a proof of work done.

It’s important to recognize that Proof of Work (PoW) is a consensus model. It’s merely a way for all the computers in the network to come to an understanding of who has what money. However, there are other, less environmentally expensive, ways of reaching this consensus. They all still revolve around having an incentive system to make sure that people play by the rules.

Proof of Stake (PoS) requires people to “stake” tokens on the network in order to be involved in the consensus system. Just as with Bitcoin where the more computational power one has, the more blocks they will “mine,” with Proof of Stake, the more tokens one has, the more blocks they’ll mine and newly minted tokens they’ll get. The two major drawbacks to the PoW protocol is the difficulty in scaling and the exponentially massive energy consumption required for network security. The debate rages between Bitcoin evangelists who champion PoW’s security, while PoS supporters highlight the above drawbacks of PoW.

Bitcoin’s Vision

Satoshi Nakamoto published a message on the first Bitcoin block:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

It’s meaning was clear: don’t trust the banks. And his sentiment was shared by many in the post 2008-crash and subsequent bank bailout. With this linked chain of transactions, Bitcoin would remove any centralized control over currency. Currency control gives banks and governments enormous power. Governments affect inflation and interest rates to control the dollar’s value. Banks manipulate and defraud customers with bonds and mortgages. A currency over which centralized power had no control would be revolutionary.

The economic model around fractional reserve banking is controversial. Its concept lies on the idea that your value of money will inevitably grow and therefore, you can take some “finances” now and be charged with interest. Banks can loan your money out to make more money and still have enough to meet your demand when you want to withdraw your money. This is great in theory. Economies have been known to scale and so logically it should be doable. However, in practice, interest, bills, costs add up. These individualistic problems are realities that we humans encounter.

The more people in debt and the more on credit create the potential for a bank run, or a massive collective withdrawal of money that can overwhelm a bank’s reserves. Thus, budgeting, accounting and finance are topics that we have studied for years in order to stop our a pending financial implosion. But borrowing and debt doesn’t stop with individuals. Countries, cities, states all manage credit for defense systems, healthcare, infrastructure and education, loaning and borrowing money. Whether the money came from the U.S, Russia, Turkey, the IMF or China is irrelevant, it needs to be paid back and its principal will grow with interest. Today, there is an estimated 63 trillion dollars worth of debt. The world runs on money. Those who control the money run the world.

With blockchain technology, the intricate Proof of Work protocol, and digital scarcity, Bitcoin would have all the attributes of a currency. It would also be divisible, just like dollars or euros. A Bitcoin can be divided down to 8 decimal places. 0.00000001 BTC is the smallest unit and is known, aptly, as a Satoshi. Bitcoin would remove the central control of institutions over currency and thus, over debt and credit as well.

The Blockchain Present

Today the blockchain scene looks very different than it did in 2008. New cryptocurrencies have taken the premise of Bitcoin and created new currencies. These currencies improve on aspects of Bitcoin, such as block time. The speed at which Bitcoin can process transactions is determined by how fast miners can solve the  Bitcoin puzzle.

Bitcoin puzzle.

As of now, it takes 10 minutes; the puzzle continues to increase in complexity to maintain that 10 minute difficulty. Only 2000 transactions can fit in a block; thus, Bitcoin can process 2000 transactions every 10 minutes. This is far from fast enough to support a global payment system. Because transactions get backlogged on the Bitcoin network, the first transactions to be processed are those that have a higher reward. When people send bitcoin, they pay a small fee that goes to the miners. The higher the fee, the larger the incentive for a miner to include the transaction in the first block. Thus, slow transaction speeds and high network demand result in expensive Bitcoin fees. Thus, other cryptocurrencies have evolved with faster blocktimes and lower fees. These include projects like Litecoin and Dash.

In addition, a new model for blockchain was proposed. The idea was that blockchain and consensus models could be used, not just for transferring value, as with Bitcoin, but for operating a decentralized computer. Just as a home computer transitions between states (a computer science term), a decentralized computer transitions between states and uses mining and governance to agree on the correct state. Applications such as smart contracts can be built with them.

The decentralized computer allows for people to program contracts that are enforced through code. A contract is a simple if and then statement. If Johnny gives me $100, then I’ll give him tickets to the baseball game. A program can dictate the terms of the contract, register that both sides upheld their end of the bargain, and transfer the value. This is all without lawyers, police, courts, or government — institutions of trust. Smart contracts are the institution of trust for our digital world. Ethereum was the first to implement smart contracts with blockchain.

New applications have designed decentralized applications around this technology. These could be anything from decentralized cloud computing systems to decentralized gambling platforms. In order to use the decentralized application, one must hold and use the platform’s token. Ether for example is the utility token of Ethereum. It’s similar to how in a casino, dollars can’t be spent. One must convert their dollars into tokens before sitting at the blackjack table. In addition, if there’s a fixed number of tokens, more people wanting to go to the casino will result in the individual price of those tokens increasing. Thus, people invest in projects by purchasing their tokens, with the expectation that as quality projects are adopted and utilized by large user bases, the value of their investment will increase.

ICOs, Initial Coin Offerings, are the new fundraising mechanism for companies. Projects issue fixed number of tokens in exchange for Ethereum or some other currency. They then use that money to develop their product.

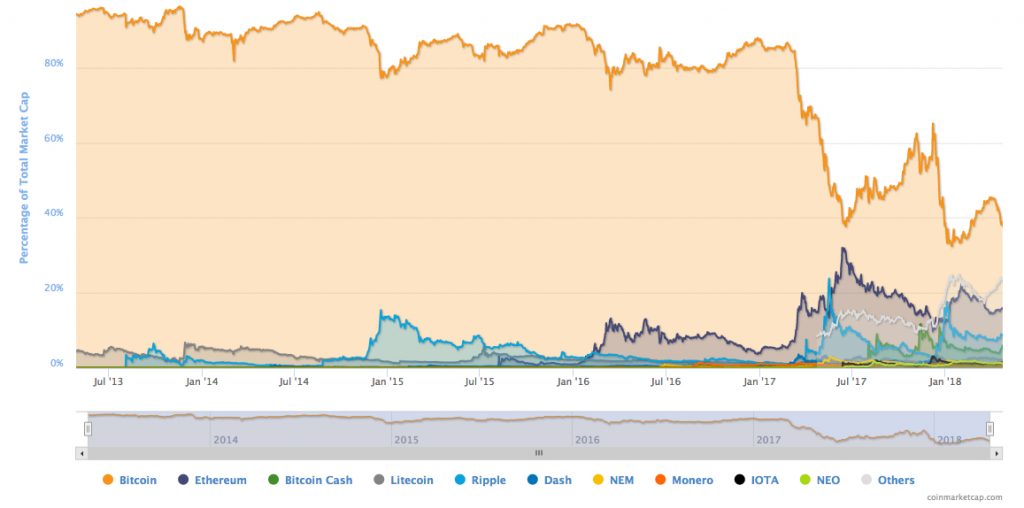

Market Capitalization in the Realm of Crypto

The market capitalization of cryptocurrencies is calculated by multiplying the price of the token versus the outstanding finite supply. Traditional equity investors use the same principal. This gives investors a tool for determining value, comparing companies, and making personal investment decisions. It often reigns superior to per-share value in determining true investment potential. The price of one share or one token is entirely arbitrary.

For instance, say firm A has 1,000,000 outstanding shares and each share is worth $15 on the stock exchange, versus firm B which is $50 per share but only 200,000 shares are public. At first glance, one could assume firm B is obviously higher in value due to its higher per-share price. However, upon calculating the market cap, or total value of the firm, B is worth $10,000,000 versus firm A’s $15,000,000. This is a relatively small-scale example, but market cap tends to provide a more concise analysis of comparison between publicly traded shares versus per-share value.

In the realm of crypto, market cap can be considered an overrated, misplaced market indicator. This is largely attributed to market manipulation of whale investors – investors who own very large sums of a cryptocurrency. They can, intentionally or unintentionally, change the fluctuations and market cap by selling their tokens. Also, as crypto is notoriously decentralized, these large players don’t have to disclose their intentions to trade, such as they would (usually at a much smaller scale) on a public stock exchange. They can simply do it at their own discretion without prior notice, which is one reason for the infamous volatility in crypto-token valuation.

Marketcap is misleading as well because it doesn’t actually represent the realistic quantity of money in the market. Because dropping the price on a small percentage of tokens significantly affects the total marketcap, it might only take a few million dollars to drastically alter the outstanding marketcap.

Taking into consideration volatile market movement, crashes, and appreciations, the inevitable increase of USD value attributed to coin value as the crypto community continues to grow, as well as the use of circulating supply in market cap evaluation (for good reason, but of course it comes with its consequences), measuring the market capitalization of cryptocurrency can be a futile exercise.

What is a fork?

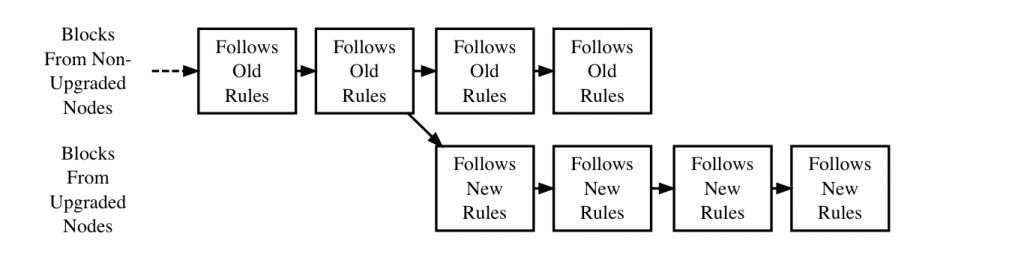

Forks are updates to the code of a blockchain. Unlike with your iPhone where Apple has sole discretion to update the software, blockchains are decentralized and require consensus to make code changes. It’s important to recognize that a blockchain like Ethereum or Bitcoin is like a constitution. It defines a set of laws and rules for how members of the decentralized network will cooperate. Thus, forks are changes to the laws and rules. Forks can occur in two ways: soft and hard. Both cause an alteration of different magnitudes to the community.

Soft forks are a change to the laws that are backwards compatible with the previous law. Hard forks are changes to the laws that are not backwards compatible. Here’s a real life example: imagine I invite friends over and set rules for the party. “Anyone at this party needs to wear a suit.” A soft fork loosens the rules: “invitees just need to be dressed.” A hard fork is a tightening of the rules: “invitees must be wearing a white T-shirt.” A soft fork allows everyone to continue operating as normal, with more leeway. A hard fork necessitates punishing those who continue to follow the old set of rules.

A softfork doesn’t create a community divide as the blockchain can continue working without mishaps; those who don’t update the code will likely just suffer an economic setback. A hardfork however can create a split of the chain as some decide to continue following the old rules and some the new. After a split, two different blockchains with unique tokens will exist. When a rule change proposal is made, the community — the miners, the users, the exchanges — must decide which chain to support.

Bitcoin’s first fork occurred when the community and developers around Bitcoin aimed to increase Bitcoin’s transaction speed. The plan was to increase the blocksize to 8MB, an 8 fold increase. This caused a direct separation in the blockchain and thus created two coins. The reason this caused a divide is because the network commanded other miners/nodes to upgrade their current software. By requiring an update, it invalidated those that refused to upgrade. BTX subsequently failed very quickly.

Bitcoin has hard forked quite a few times and the original Bitcoin has managed to stay on top in terms of market valuation. Furthermore, Bitcoin has found temporary successes with soft forks. To give an example, Bitcoin’s Segwit fork was a soft fork, increasing Bitcoin blocksize from 1MB to 2MB. This allowed a higher number of transactions to be processed in a shorter time frame and at a cheaper cost. At the same time, Bitcoin blocks that could only grow up to 1MB were still valid and could be processed. Thus, the ecosystem was not split; it simply learned to live with new rules.

Ethereum vs Ethereum Classic

In May 2016, members of the Ethereum network proposed the idea to form a decentralized autonomous organization (DAO). A DAO is merely a cooperation, but instead of a board of directors and executive management team making the decisions, it is a set of laws and rules encoded into smart contracts. This particular DAO would fund various projects according to the community’s votes. Users would send in ether to the organization and in turn would receive DAO tokens, with entitled to them voting rights. On the 18th of June, 2017, a hacker exploited an error in the DAO code and successfully drained $70 million of the total $150 million.

The hack caused a split within the community. Some felt that the Ethereum blockchain should be “undone” up until the point of the hack, effectively refunding victims’ ether. Others championed the code is law premise of blockchain. They believed that changing the blockchain was an inherent violation of blockchain’s fundamental message: that it is immutable and can’t be reversed, no matter the circumstances. Refunding this money, while seemingly the moral action, would create a “slippery slope.”

Ultimately, the network could not come to a consensus and a hard fork resulted. This physically divided the community into two blockchain: Ethereum and Ethereum Classic. The original Ethereum effectively reversed the stolen ether back into the rightful accounts. Ethereum Classic was the Ethereum network where miners refused to fork back funds. Today, Ethereum remains the main development platform for ICOs and decentralized applications. This highlighted a critical question within blockchain: does the public actually want true immutability?

Ultimately, the network could not come to a consensus and a hard fork resulted. This physically divided the community into two blockchain: Ethereum and Ethereum Classic. The original Ethereum effectively reversed the stolen ether back into the rightful accounts. Ethereum Classic was the Ethereum network where miners refused to fork back funds. Today, Ethereum remains the main development platform for ICOs and decentralized applications. This highlighted a critical question within blockchain: does the public actually want true immutability?

While Ethereum was the first platform to support smart contracts, and thus, decentralized application development, it has strong competition today. Amongst its competitors are NEO, QTUM, and Cardano.

What is NEO?

Neo is largely focused on the Chinese market. Neo has the means to become a more improved Ethereum with a unique scaling model. One of Ethereum’s limitation is its scaling, largely due to their us of a PoW consensus protocol and not PoS. Furthermore, Ethereum is powered by ether. Ether is what helps  incentivize network mining and security (fees, paying miners, etc.). Ether is both a means of exchange, as well as its own fuel. For NEO, this is not the case. NEO uses the Neo token as a governance token and Gas as the fuel to run the network. In contrast to its more efficient PoS consensus model, and its dual token model, NEO is also more centralized than Ethereum. This is both a positive and negative. While centralization makes NEO more vulnerable, having a reputable organization responsible for its operation may give enterprises the confidence to transition to NEO’s blockchain.

incentivize network mining and security (fees, paying miners, etc.). Ether is both a means of exchange, as well as its own fuel. For NEO, this is not the case. NEO uses the Neo token as a governance token and Gas as the fuel to run the network. In contrast to its more efficient PoS consensus model, and its dual token model, NEO is also more centralized than Ethereum. This is both a positive and negative. While centralization makes NEO more vulnerable, having a reputable organization responsible for its operation may give enterprises the confidence to transition to NEO’s blockchain.

NEO is currently operational and hosting ICOs.

What is Cardano?

Headed by a stellar team, Cardano brings a new consensus model to blockchain platforms. Their PoS model, Ouroboros, aims to be highly efficient and final, reducing the chance to unintended forks. In addition, their platform incorporates layers. The layers split the business and transaction logic. Business logic is the smart contract code and transaction logic is the actual network transactions utilizing ADA — Cardano’s currency. By dividing the layers, they provide a more customizable and easily upgradable system, as well as one that ensures that contract execution isn’t bottlenecked by transaction quantity.

Headed by a stellar team, Cardano brings a new consensus model to blockchain platforms. Their PoS model, Ouroboros, aims to be highly efficient and final, reducing the chance to unintended forks. In addition, their platform incorporates layers. The layers split the business and transaction logic. Business logic is the smart contract code and transaction logic is the actual network transactions utilizing ADA — Cardano’s currency. By dividing the layers, they provide a more customizable and easily upgradable system, as well as one that ensures that contract execution isn’t bottlenecked by transaction quantity.

All of Cardano’s code is peer reviewed by leading academics to ensure that their platform is secure and stable.

Only Cardano’s transactional platform, not their smart contracts, is currently operational.

What is QTUM?

Like NEO, QTUM is also a platform developing in the China. QTUM is a hybrid of Ethereum and Bitcoin technology, utilizing aspects of Bitcoin for strong security while utilizing Ethereum elements for ICO and decentralized application development.

Like NEO, QTUM is also a platform developing in the China. QTUM is a hybrid of Ethereum and Bitcoin technology, utilizing aspects of Bitcoin for strong security while utilizing Ethereum elements for ICO and decentralized application development.

QTUM aims at making blockchain user friendly and simple to use. They focus on the user experience and aim on onboarding institutions and businesses. QTUM also employs a highly customizable system that allows endless changes making it immune to forking.

How to Obtain Cryptocurrencies?

There are three major cryptocurrency exchanges available today which allow the exchange of fiat currency (USD, Euro, etc.) into crypto. Coinbase, Gemeni, and Kraken are the primary online exchanges allowing users to purchase cryptocurrencies with fiat. However, buys are generally limited to the most popular tokens: Litecoin, Bitcoin, Ethereum and Bitcoin Cash.

After purchasing one of these currencies, consumers can send their funds to other exchanges where they can trade them for altcoins (alternative coins — a term encompassing any non-bitcoin token). The most popular exchanges are Binance, Huobi, Bittrex, Bitfinex, and OKEX, among others. Tokens should only be traded on exchanges, never stored there. Hacking passwords to accounts is much easier than hacking into private wallets stored on hard drives.

Thus, desktop wallets like myetherwallet (for Ethereum based projects) and NEON (for NEO based projects) are better options. The most secure way to hold your crypto is through use of a Ledger Nano or a Trezor hardware wallet.

In January 2024, the U.S. Securities Exchange Commission (SEC) gave its approval to shares in funds based on volumes of crypto being traded on the U.S. stock exchange. Now known as ETFs (Exchange-Traded Funds), share values track the value of Bitcoin, and investors do not need a wallet to actually hold any Bitcoin. The surge in demand for Bitcoin from major institutional investors including Blackrock has sent Bitcoin’s value rising in 2024.

Conclusion

What started with Bitcoin has exploded into a whole new economy, a new way of fundraising. While security risks, difficulty of use, and ignorance present legitimate hurdles to adoption, there is no doubt that blockchain holds significant potential. It could revolutionize the way we exchange value, the way we interact in the digital world, and the way we store information.

This future will largely be dictated by the networks in development. Whether it be a network that operates as a smart economy market place or a network that underpins financial institutions, trade-offs regarding transaction speed, security, and decentralization will need to be made. As we speed towards this future, we will learn the hard way what compromises we can afford, and which ones we can’t. Money will be made, money will be lost, but decentralization may prove transformative.

0 Comments