In the seven years since I launched Crowdsourcing Week the Covid-19 pandemic is undoubtedly the biggest, and most awful global phenomenon. The pandemic lockdowns announced by most national governments meant the worldwide pool of available skilled labor grew virtually overnight, across all age groups. How has it affected you? Have your plans been put on hold, or do you see some opportunities opening up? Is it true that necessity is the mother of invention, and you are acquiring new workplace skills? Here is my look at some ways that crowdsourcing and crowd-based business models can support businesses and the people associated with them during this turbulent time.

Many futurists were already forecasting increasingly high levels of job losses due to the introduction of robotics and machine learning fuelled by artificial intelligence. Workers performing repetitive tasks are reckoned to be the hardest hit. The UK innovation foundation Nesta previously forecast that up to 30% of existing jobs were at risk anyway, and the process is likely to accelerate as businesses carry out their enforced reviews of how to continue trading. Though the new jobs that don’t yet exist are also perhaps nearer.

We’re not talking about just warehouse shelf stacking and item retrieval, unmanned lawn mowers, flipping burgers, and laying bricks on construction sites. Legal searches, translation and transcription services, call center staff, bank tellers — all are at risk. The work least affected by artificial intelligence is creative, collaborative, utilizing a wide range of skills, and is flexible. That’s where people should increasingly look for opportunities, and what education should prepare more people for, according to Catalina Schveninger, the Head of HR at UK-based online education platform FutureLearn. In a recent article we also took a look at the fast growth of the Skillshare platform that provides video guides for improving creative skills.

Maurizio Rossi, co-founder and CEO of H-FARM, Europe’s biggest and most unique hub for innovation and education, believes the pandemic could cause many businesses to bring forward plans for a move towards greater examination of new possibilities. He says:

“Crowdsourcing has an opportunity to evolve itself, defining new smart working formats and consequent engagement of competences. We’ll see an increasing use of the so-called “digital flexibility” to redefine organizations and their engagement processes and access to competences and opportunities. Covid has simply accelerated by a few years a process that was already on its way, stimulating an increasing awareness at large scale.”

Open Innovation

It is increasingly accepted that open innovation, often through a process of turning a business challenge into a prize competition, uncovers new solutions faster, more cost effectively, and frequently from very different types of people compared to a company’s regular workforce.

All businesses have had to handle supply chain disruption, a retail shutdown, remote working —where it was possible, and now safeguarding employee health as a return to work starts to take shape. Research conducted by PwC among U.S. CEOs shows a majority are positive about how their companies responded in a period of high levels of enforced change. They are reassured the company stakeholders can cope with change, so what else is there to look at changing?

Christian Cotichini, CEO of HeroX on Canada’s west coast, sees the need for a fast post-pandemic recovery as a stimulus for new prize challenge users to test the opportunities and benefits. At the same time, I have heard they are developing an “equity crowdsourcing” proposition. We all understand equity crowdfunding that trades a slice of business ownership for a cash investment. Equity crowdsourcing could be a way to reward prize challenge winners with equity, and thus tie them in closer to the business as a result. Could this revolutionize how we spend time on the internet?

Crowdfunding

Small businesses are a national economy’s foundation stone. In April 2020, a report said US small businesses employ over 47% of all Americans in the workforce. In the UK, recent government data showed small and medium enterprises (those employing under 250 people each) employ 60% of the total UK private sector workforce. They are vital to national economies: which direction do you think these numbers are heading in right now?

Crowdfunding really kicked off in response to post-2008 financial crash banking regulations that starved small businesses of funding. Kickstarter and Indiegogo gave product innovators an online route to market. Equity crowdfunding democratized access to seed round investment funding for startup business founders who lacked personal connections to a network of VCs and HNWIs. How might we see crowdfunding develop post-2020?

Karen Cahn, founder of IFundWomen, says rewards crowdfunding is a fantastic way for a wannabe entrepreneur to check public demand for a new product before melting down credit cards in debt. If the demand is there, they can go ahead safely. If a product doesn’t secure enough pre-orders to make it worth producing a first batch, then they can rethink their plans without having amassed a big debt.

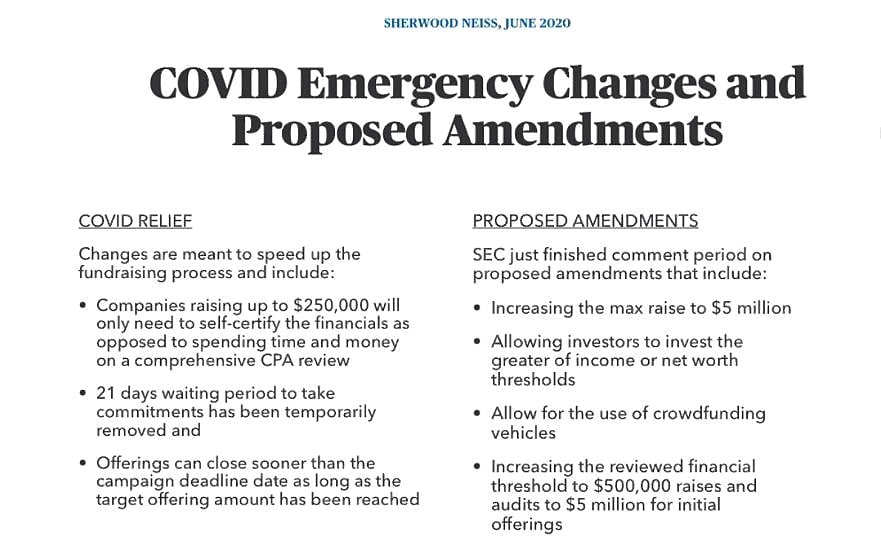

Equity crowdfunding enables building a business through attracting shareholders. U.S. platforms StartEngine and Wefuunder had already hit record high investment levels in Q1 2020, and then the U.S. SEC (Securities Exchange Commission) relaxed Reg CF rules temporarily until February 2021 to make it less expensive and faster for businesses to raise investment funds. In August they widened the base of accredited investors by allowing professional qualifications to replace former demarcations based on income or savings definitions.

Source: Sherwood Neiss, Crowdfund Capital Advisors

Gig-Economy and Freelance Work

Recessions naturally drive up unemployment across the population, though the effects are more severe for those who have only recently left full-time education, and not just in the short-term. Research into the impacts of previous recessions shows that employment rates throughout the first wave of cohorts that leave education during a financial crisis remain lower than for those who leave education after it – with non-graduates experiencing the largest and longest scarring effects. To say it’s going to be tough for them is rather an understatement.

Though new entrants to the job market have better access to technology for remote working, with more advanced freelance and gig-economy opportunities everyone has a chance to demonstrate proactivity and self-discipline. This is by improving their workplace skills through short-term contracts or assignments via platforms including Freelancer.com, Upwork, and Fiverr.

The pandemic lockdowns announced by most national governments mean the worldwide pool of skilled labour grew virtually overnight, across all age groups. Freelancer.com is the largest freelancing and crowdsourcing platform in the world by total number of users and jobs posted, connecting users with skilled jobs and tapping into the best talent and ideas.

“Since Covid-19, we have seen exponential growth in user sign-ups suggesting a strong desire for individuals to get back to work and, in some cases, to do so on their own terms. Post-pandemic, the gig economy will continue to grow and we will see traditional workforce models evolve into an on-demand workforce,” Sebastián Siseles, vice-president – International at Freelancer.com, said.

Crowd finance – cryptocurrencies

Recent economic measures to try and maintain a functioning economy have seen a growing number of countries reach a debt level greater than a year’s GDP (which now includes the UK, France, and Spain), and Quantitative Easing which effectively devalues the fiat currencies of the countries involved. Scott Trowbridge of WeWork Labs says that although holdings in cryptocurrencies are too low for any of them to yet be a viable alternative, the people active in this sector are very likely to increase their exposure as protection against negative impacts on fiat currencies .

How much more attractive might cryptocurrencies appear in the new normal, both to individuals and businesses protecting asset values?

Social Businesses

In the new normal, we’re expected to become more aware of the needs of others, to share more often rather than try to out-do them. A recent KPMG report suggests three central factors of environmental, social, and governance criteria will play a greater role in measuring the sustainability and societal impact of an investment in a company or business.

There is already a cohort of new business builders who do not put personal reward as their main ambition — unless their top idea of reward is the satisfaction of helping others more than aspiring to acquire a home with a helipad or on a private island. Generation Share, a book published by Benita Matofska, includes interviews with many entrepreneurs around the world whose primary aim was to create a business that first benefited other people, so long as it could make enough to be viable. Maximum profit for personal gain was not the prime motivation.

This article was originally published at Maize.io.

0 Comments